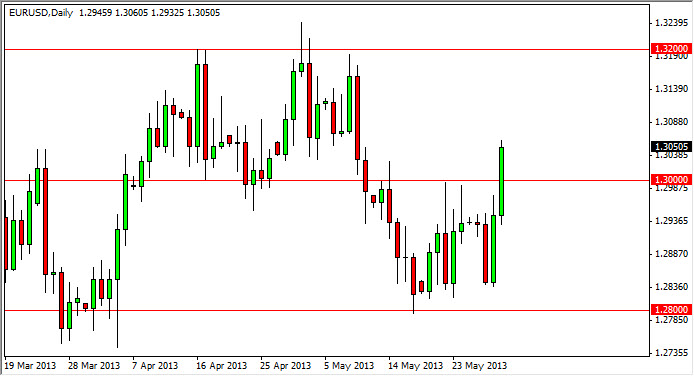

The EUR/USD pair broke out above the 1.30 level during the session on Thursday, which is an area that I thought would be rather resistive. It has been for some time, but you can see that it gave way during the session today. That being the case, I think that this market is ready to start bouncing around in the upper half of the larger consolidation area.

The 1.30 level should now start act as support, and the resistance will be focused on the 1.32 level. I have a hard time believing that the Euro will certainly take off though, because quite frankly there are far too many issues in the European Union to believe that the Euro will suddenly find massive strength. Granted, the last two days of been pretty stout, but I think the area just above should offer enough resistance that we should see a bit of a pullback in this vicinity.

1.30 should be crucial

The 1.30 handle should be crucial to see whether or not we can keep in the upper half of this consolidation area, or if we drifted back down into the lower half. Either way, I believe that this market will be choppy throughout the summer, and even though we have seen strength, I wouldn't count on it being that big of a deal in the end. Having said that, I don't necessarily think that a fall from here would be a big deal in the end either. Simply put, I think that we are trying to find the summer range that will keep this market from being trending in general.

There is the possibility that we could see headlines come out of the European Union that sends this market lower, but quite frankly I think the market has become very complacent at this point. Having said that though, you're going to have to pay attention to the headlines because there are so many potential landmines in that region of the world. Quite frankly, the Euro’s best friend is the Federal Reserve, as the Federal Reserve continues to devalue the US dollar.