By: DailyForex.com

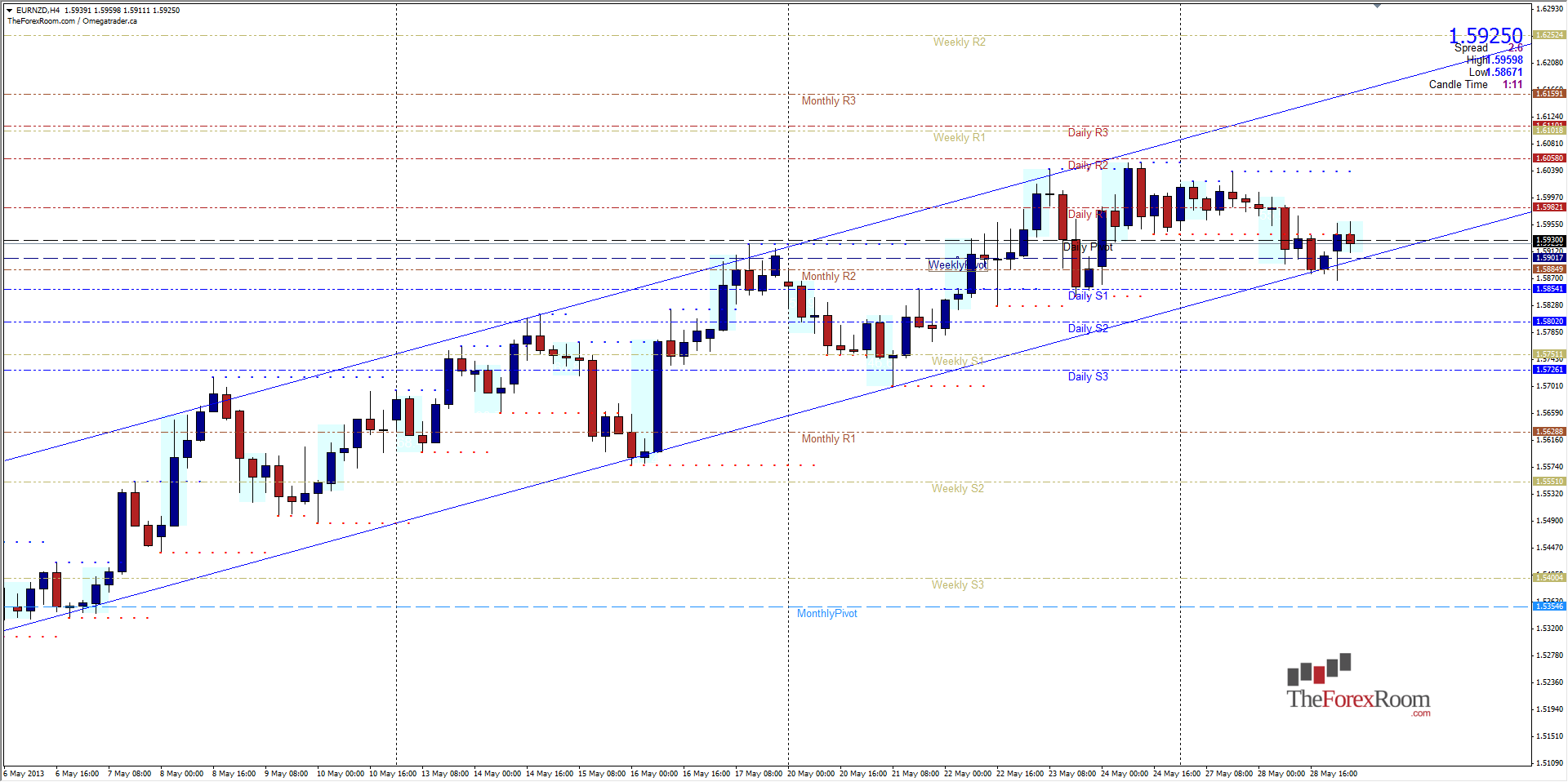

The battle between the EURO and Kiwi rages on with the pair passing the bearish/bullish torch back and forth with enough regularity since April to form a very clear 4 hour ascending channel. During Asian market hours today we have seen the pair test and find support at 1.5867 and forming a potential hang man candle pattern in the process. This is a bearish pattern as a matter of fact and a close below this low would also complete a close outside of the ascending channel which could possible signal a long overdue bearish run for this pair. That said, as the low formed at the lower band of the channel it could also signal a rejection of said lows and we could now see the top of the channel at roughly 1.6100 tested if the recent pattern holds. There is resistance in the form of last week's highs to get through at 1.6050 and a weekly R1 at 1.6100, so if we do se this pair test these levels we will probably see a drop from there if not sooner. That said, the Kiwi is has been continuing to weaken but finding some form of possibly minor support over the last 4 hours so if we trade what we see, we will have to wait for either the 4 hour high or low to break for a better idea.

Happy Trading