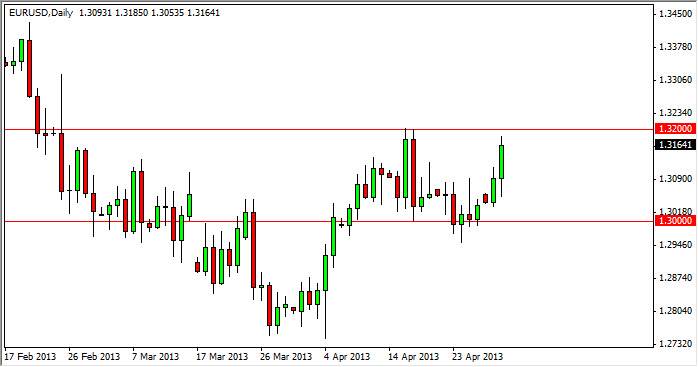

The EUR/USD pair rose during the session on Tuesday, breaking above the last remnants of the shooting stars from the past couple of weeks. This of course is a very bullish sign; however we have seen significant resistance of the 1.32 level previously, so I'm not quite ready to start buying yet. In fact, I am very leery of trading this pair at all based upon the recent history of it.

This is a great barometer for what the Euro is doing overall. However, that doesn't necessarily mean that there is always going to be a trade in this pair. I quite often use this chart as a tertiary indicator on what the strength or weakness of the Euro truly is. For example, I may see that the Euro is doing quite well on this chart, and therefore think that buying the Euro against other currencies that are weaker than the Dollar may be the way to go. The method is called "triangulation."

1.32 will be an important area for me

However, having said all that I am willing to buy this pair above the 1.32 level but I need to see a daily close up there. This is because the pair has been so volatile over the last several months that even when it's commonly drifting up or down, you can see bits of choppiness everywhere. I have known so many professional traders that have simply given up on this pair during the last nine months that it's not even funny and instead have all focused on the Yen until recently.

Looking forward, I can give you far too many resistance and support levels for a longer-term trade, but I think of the 1.32 level gets violated and closed above we will more than likely see a move up to the 1.34 handle in relatively short order. On the other hand, we can manage to break down below the 1.2950 level; I think we will test the 1.2750 level yet again. In the meantime, this is a short-term traders market, playing the obvious range for handfuls of pips at a time.