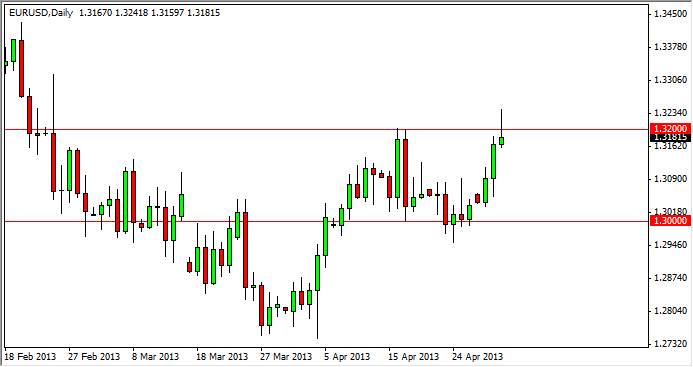

The EUR/USD pair rallied for most of the session on Wednesday, but as you can see gave back quite a bit of the gains in order to form a shooting star. This shooting star was placed just about as perfectly as possible if you are bearish of this pair. This is because the 1.32 level which had been resistive the last time we were here, has now become the focal point of this shooting star. Because of this, it appears that we could see a pullback in this marketplace.

There are plenty of reasons to be concerned about the Euro overall, and the bullishness that we've seen over the last couple weeks is probably been a bit premature. After all, your of is essentially in a recession, while the United States is growing, albeit slowly.

European Central Bank meeting

The European Central Bank has a meeting during the session today, and you can expect that the market will be paying attention to the statement coming out of that central bank. Because of this, we could see a very volatile session in the Euro, but I cannot justify buying until we break the top of the shooting star. This more than likely won't happen until after the central bank meeting, so I would assume that the reaction would be bullish for the Euro overall.

There are a lot of different thought processes when it comes to what the ECB is going to do. However, there have been conflicting reports out of Brussels, and as a result it's difficult to trade this central bank meeting before it happens. With that being the case, we simply can only trade technical signals, and as a result I think that if we see a breakdown below the lows for the session on Wednesday, we should see this pair drop.

However, you must keep in mind that Friday is the nonfarm payroll announcement day, and as a result any movement over the next 24 hours will more than likely be sharp, and isolated.