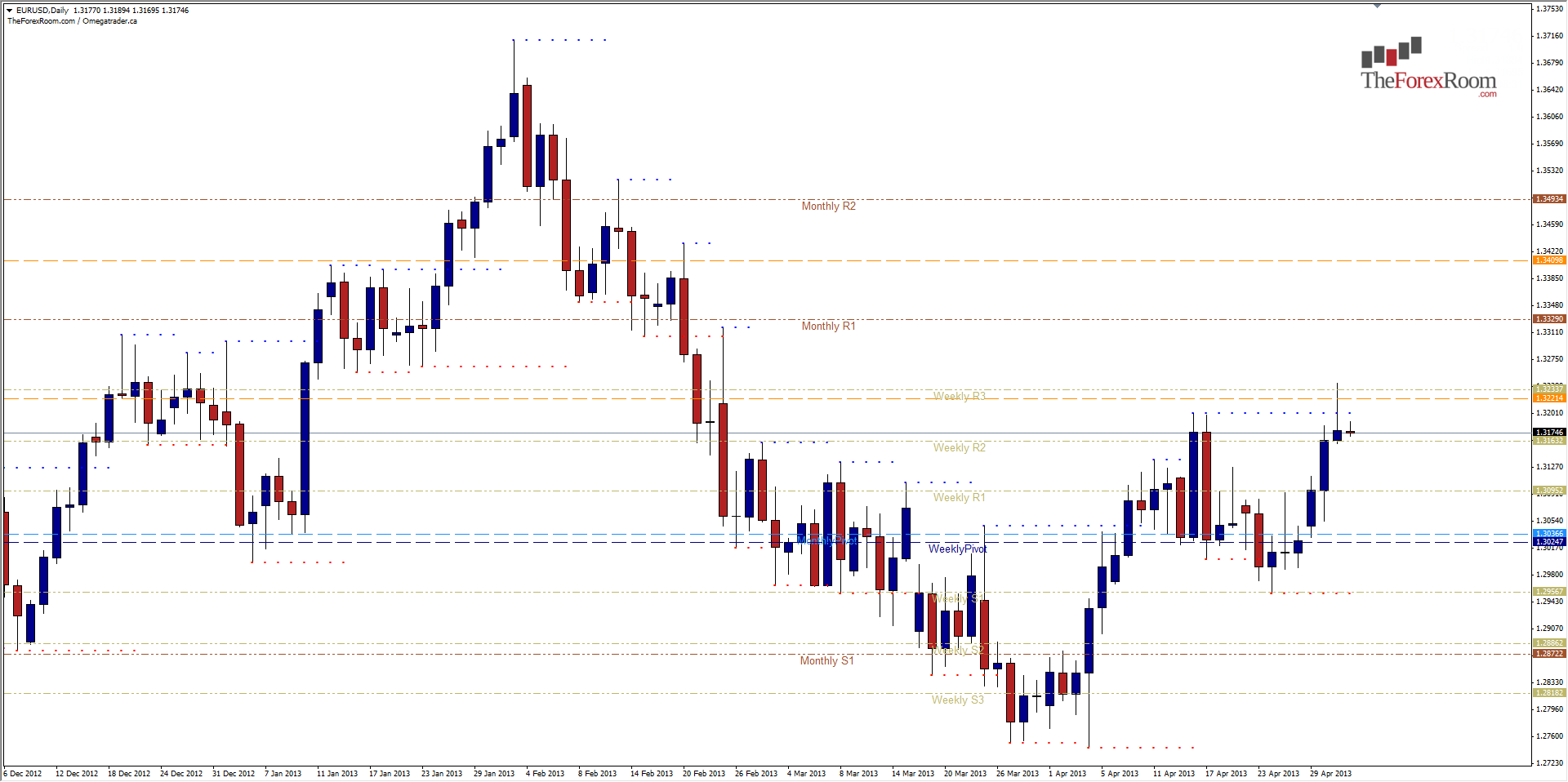

The EUR/USD started the day yesterday looking like it was going to head for 1.3300 and nothing was going to stop it. Oh what a difference 24 hours makes. After the FOMC statement, the pair reversed, or rather continued to reverse off its high at 1.3242 and close only slightly higher than it opened the day. The result was a Daily Pin bar off of the 1.3200 resistance level and bearish divergence on the indicator of your choice such as the Stochastic Oscillator or MACD. This is a stong bearish signal and if one looks at open orders for various brokers, we can see that traders around the world are bearish as a result. We went from about 60% bearish orders to almost 80% bearish orders on this pair and growing. We have a hectic couple of days ahead with the ECB policy statement and Non Farm Payrolls coming up so do be cautious. That said, if selling this pair watch for support at 1.3100, 1.3050 and 1.2950 with resistance for the buyers above at 1.3200, 1.3250 and 1.3330.

EUR/USD Rejects 1.3250 - May 2, 2013

By Colin Jessup

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox. Please enter a valid email address

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown. - Labels

- EUR/USD