By: DailyForex.com

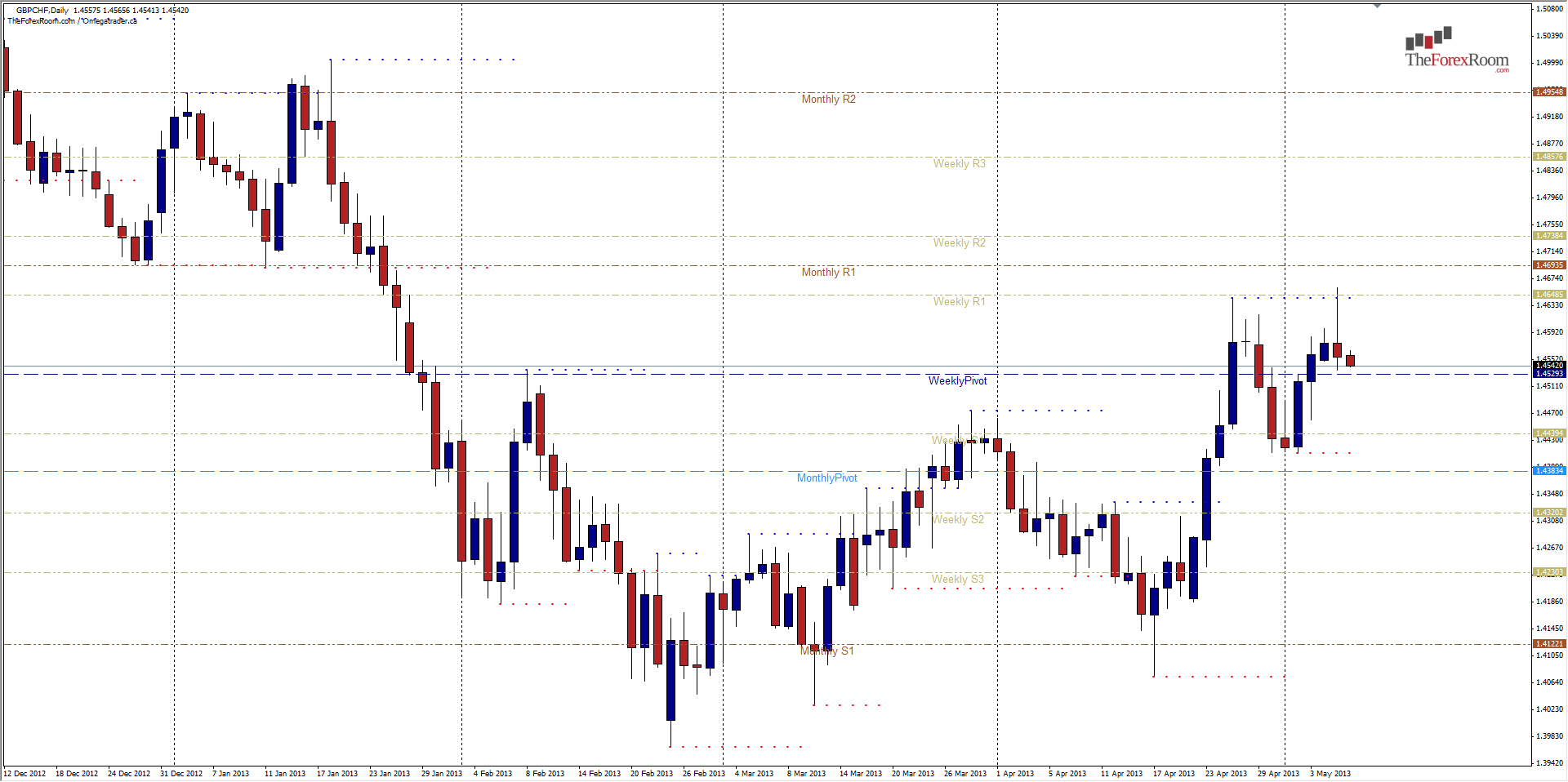

The British Pound is showing signs of weekness across most of the key currencies, but none are showing so clearly as the GBP/CHF. THis pair has now made a double top on the daily chart and printed a Pin Bar Reversal candle this time around, AND the double top is the right arm of a large daily 'W' formation, a reversal pattern in itself.

Although key resistance resides a little higher(1.4690/January Lows) than the pair reached yesterday (1.4660), the pattern is indeed a good indication in and of itself and forms at the Weekly R1.

Support sits in the form of February's high and Weekly Pivot at 1.4530 with additional support at March highs of 1.4474 as well as last week's lows at 1.4401. If the bears can break the 1.4400 area it is possible that we will slide all the way back down to the 1.4200 area or lower. Watch the 1.4300 area for support off of consolidation levels from February, March and April with further resistance above at 1.4740 & 1.4860 before seeing a retest of January's highs in the 1.5000 area.