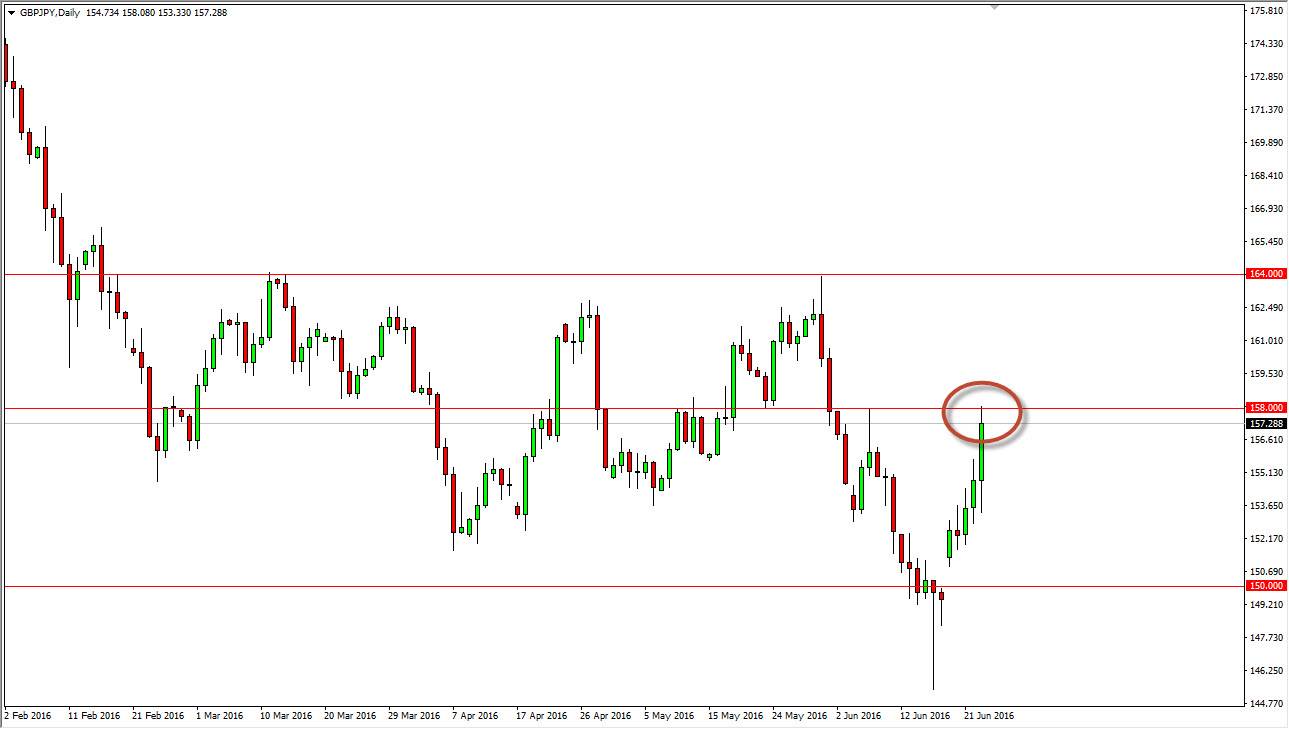

The GBP/JPY pair shot straight up during the session on Thursday, as the Yen sold off against almost everything. That being the case, it's not a surprise that this market really took off and we managed to break above the 155 handle. After all, this pair is much more volatile than the USD/JPY one, and as a result the moves tend to be much stronger in both directions.

It appears that we have broken out some type of ascending triangle recently, and as a result it appears that we will see a significant move higher, perhaps as much is it hundred pips or so. That being said, that would put us at roughly 160, which I don't think is really that big of a stretch. After all, the Yen is been beat up on by the Bank of Japan, and the Prime Minister has suggested that inflation of 2% is going to happen. With both the Prime Minister and the head of the Bank of Japan staking their political careers in this move, you can bet that they will try their best.

Long-term move

Now that we have broken above the psychologically significant 100 level in the USD/JPY market, the Yen can continue to melt down against all other currencies. This is exactly what I expect to happen, and quite frankly the analysis is about as simple as it gets: sell the Yen. It really doesn't matter what you sell it against, but there of course will be better markets than others.

I believe that this particular market will do quite well, especially considering that the British pound has seen a bit of a resurgence lately. On top of that, this pair is and as liquid as some of the other ones, so therefore the move could be relatively strong. I also like a couple of other Yen related pairs, namely the Aussie and the Kiwi. All three of these currency pair should perform very well over the near-term, and as a result I think that we could be entering a long-term phase of Yen selling yet again.