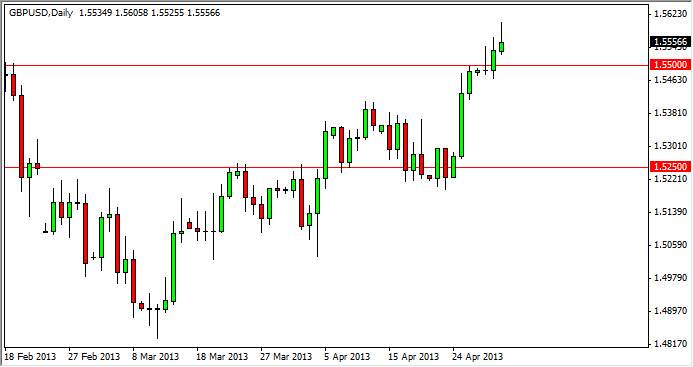

The GBP/USD pair rose during the session on Wednesday again, as we continue to march from the 1.52 level that we were at just a week ago. However, later in the session on Wednesday we saw the sellers stepped back into the marketplace and push this pair down enough to form a shooting star. This shooting star isn't necessarily placed at a particularly important spot, but the fact that this is the second one in three days does tell me that this pair is perhaps getting tired.

With that being said, I am very leery of going long of this market at the moment. There is a bit of the channel that has been formed over the last couple of months, and we are most decidedly at the top of it, so this could just be a simple matter of reacting to potential resistance. This could lead to a pullback, and maybe not much more than that, so this could intentionally end up being a nice buying opportunity.

All things being equal, I believe that the 1.54 level should offer support in this market. Unless we get below that level, I don't think there is any potential for a significant selloff at this point. Alternately, we could possibly pop above the top of the shooting star from the session on Wednesday, and that would be an extraordinarily strong side of bullishness as the market continues to chew through all resistance.

Nonfarm payroll

The biggest problem that I have trading this pair at the moment is that it tends to be relatively sensitive to the nonfarm payroll number that comes out on this Friday. That being the case, we could see the market simply slow down for the next session or two, in anticipation of that vital economic announcement. It will be very interesting to see what happens, but in reality I think that a pullback almost needs to happen after the fairly strong showing that this pair is had over the last five or six days. That being the case, I'm actually rooting for a bit of a fall in order to be able to buy the British pound at a cheaper rate.