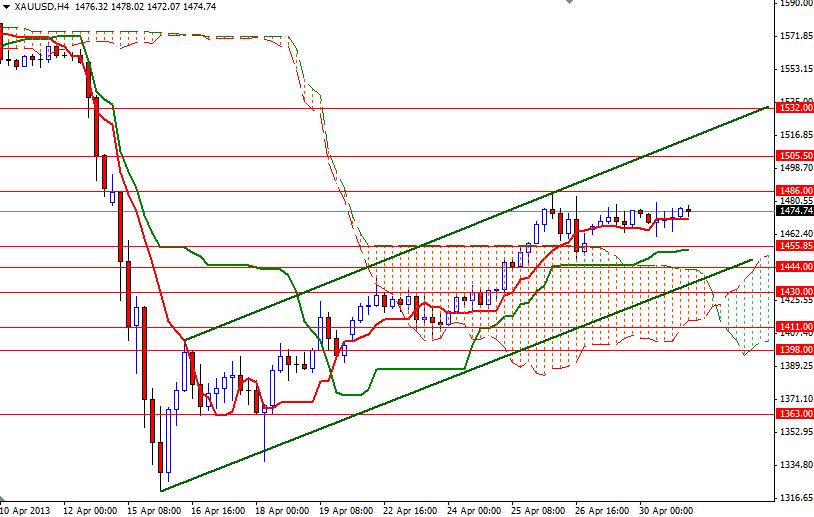

Recently the XAU/USD pair (Gold vs. the Greenback) has been trapped between the top of the Ichimoku cloud which sits at the 1444 level and a historical support/resistance level at 1486. Yesterday, data from the world's biggest economy were mixed. The Chicago purchasing managers' index came out weaker than expected with a print of 49 (52.4 previous) and data released by the Conference Board showed that its consumer confidence index climbed to 68.1 from 61.9 the prior month. Although there are important data releases such as ADP non-farm employment change and ISM manufacturing PMI today, the eyes will be on the Fed as Federal Open Market Committee policy statement is the main event of the day. After last week's GDP figures which indicated the economic recovery was losing momentum, I don't think that FOMC members will be in a hurry to slow or to stop asset purchases before the end of 2013. However, from what we have seen so far, some voting members of the FOMC are highly concerned about the Fed's large balance sheet. If the central bank decides to end its quantitative easing program at an earlier date than expected, this would probably erode support for gold. From a technical point of view, in the short-term it will be hard to trade gold as the trading range is so tight but at the end will soon reach a point where it will simply have to break one way or the other.

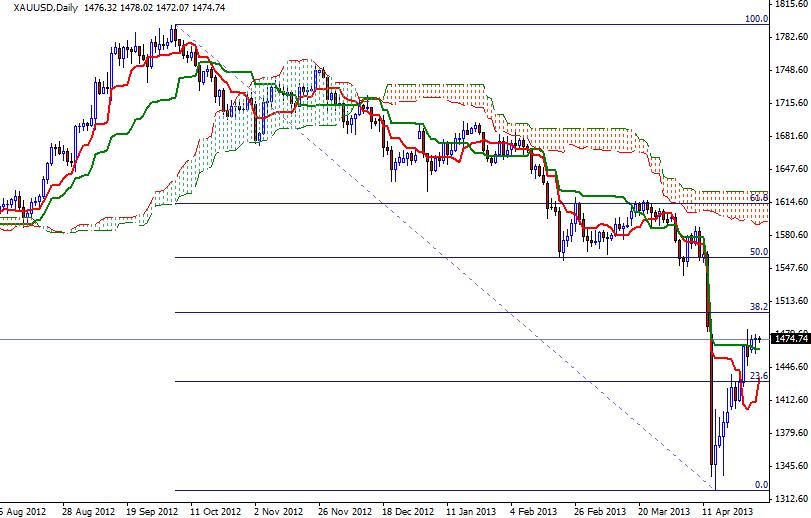

The key level to the upside will be the 1486 level. If bulls manage to break and hold above this level, we may see a bullish attempt towards the 1500/1505 resistance which happens to be the 38.2 Fibonacci retracement levels based on the bearish run from 1795.75 to 1321.52. Beyond that, I see very strong resistance at 1532. If the bulls fail and prices reverse, support to the downside can be found at 1455, 1444 and 1430. A break below 1430 would make me think that we are going to test 1398 next.