The XAU/USD pair tried to reach the 1486 resistance but failed as the USD bulls gained some strength after the report released by the U.S. Labor Department revealed initial jobless claims dropped by 4K to 323K, the lowest level since 2008. The pattern on the daily chart suggests that neither the bulls nor the bears have enough power to breach current consolidation borders. Apparently the sentiment in the market is very mixed. Some investors think that gold will continue its bullish run as central banks around the world ramp up stimulus to boost their economies. They believe physical demand for gold will remain high and more buyers will come to the market if prices drop further.

On the other hand, some investors suggest that the price action we saw in April (i.e. breaking out of a giant consolidation area which the market was following since September 2011) is more than a correction and hence the bullish trend is over. These investors think strengthening American dollar will accelerate the downward movement.

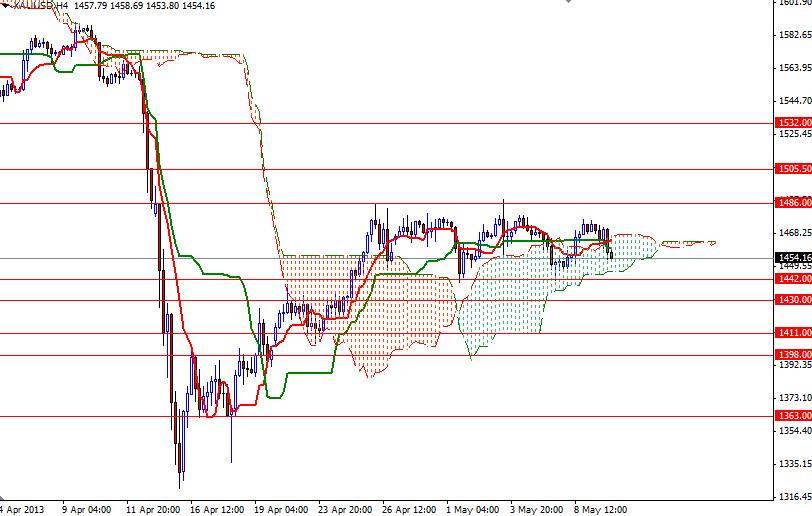

From a technical perspective, the weekly and daily charts remain bearish as the pair trades below the Ichimoku cloud. Because of that, there will be significant resistance levels ahead and breaking through these barriers will not be so easy. However, in the near-term, I will be following the 4-hour chart. Although being trapped in 1486 - 1442 range is boring for sure, breaking out of this rectangle will determine the next move. If the 1442 support gives way, the bears will be targeting 1398. On its way down, expect to support at 1430 and 1411. If the bulls take over and push the pair above the 1486 level, it is likely that we will see prices testing the next strong at 1532. To the upside, resistance will be found at 1505 and 1514.