The XAU/USD pair posted first weekly loss in three weeks as a strong rally in the U.S. dollar pushed prices down. Friday's settlement was the lowest closing price since April 24. Gold has been under pressure for some time because of the persistent improvement in U.S. data and expectations that the Federal Reserve will scale back quantitative easing before the end of 2013.

Since quantitative easing (i.e. money printing) has been the fundamental driver of higher gold prices since 2008, the market might show a stronger reaction if the U.S. Federal Reserve reduces its monthly asset purchases. A media report saying that the Fed officials are focusing on finding a strategy for how and when to exit from bond buying program had a strong impact on the market as well. I think the policy makers have to be very careful at this point because, as we often say, the market does not like it when predictability is replaced with uncertainty. It appears that the lower gold goes, the more physical demand comes in but on a retail investor level. Until significant demand comes from central banks and huge investors, the XAU/USD pair will not be able to pull itself out of the bears' grip.

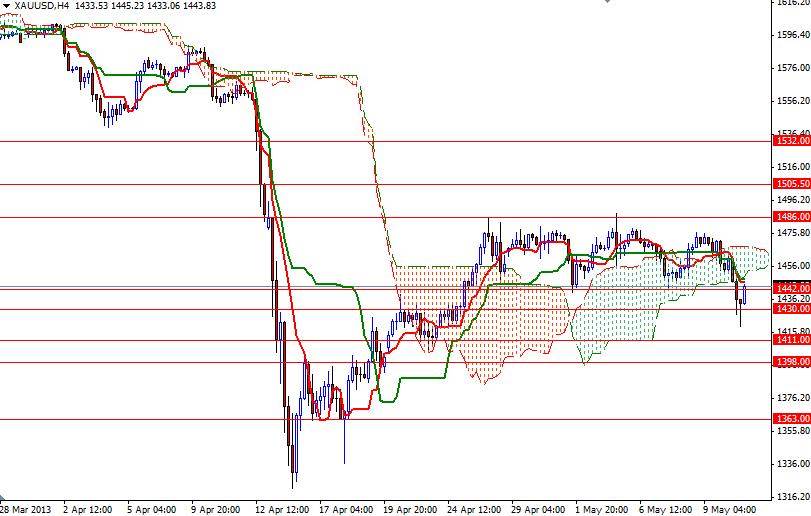

Technically speaking, based on the fact that prices are below the Ichimoku clouds, the long term outlook remains bearish. On the 4-hour chart we have a bearish Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-day moving average, green line) cross and Friday's price action dragged the XAU/USD pair below the clouds. Because of that, I will be looking for further weaknesses at the resistance levels to join seller, until the bulls manage to break through the 1486 level.

From an intra-day perspective, resistance to the upside will be found at 1454, 1458 and 1476.50. If we break through the resistance level of 1486 and manage to hold above that, then we could see a test of the 1532 level. If prices resume the bearish tone of the last few days and closes below 1442/1438, I will be looking for 1422, 1411 and 1398. A close below 1398 would suggest that we are heading back to 1363 at least.