Gold prices (XAU/USD) closed the session lower than opening on growing expectations the U.S. Federal Reserve will reduce the pace of monthly asset purchases. Market participants think the central bank is setting the stage for an exit from its bond-buying program. Lately, comments from the central banks' officials showed that several Federal Open Market Committee members were highly concerned about the risks of more quantitative easing. If the Fed stops providing a flood of cash, this might cause a negative effect on gold prices.

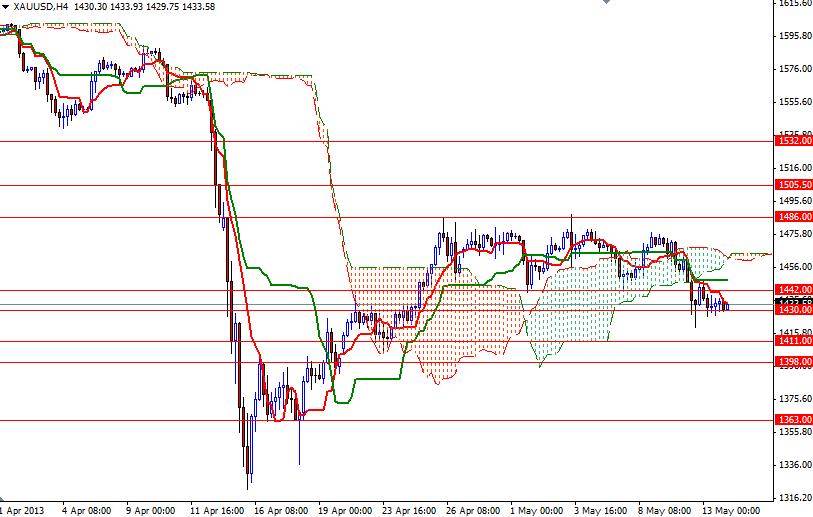

The 4-hour chart suggests that the XAU/USD pair is trying to form a bottom around the 1430 level but for now we are stuck in a tight trading range as the market simply has no real catalyst to push prices in either direction. Although Asian demand for physical gold has been strong in recent days, it won't last forever and the performance of the major equity markets is likely to continue to weigh on the precious metal. Technically speaking, the bulls have to push prices above 1486 in order to gain control over the market but before reaching that level there will be resistance at the 1464 level, which is the top of the Ichimoku cloud on the 4-hour time frame. Until prices climb above the Ichimoku cloud and the Tenkan-sen line (nine-period moving average, red line) crosses above the Kijun-sen line (twenty six-day moving average, green line), the odds favor the sellers. If the bearish pressure continues and prices break below the 1430 support level, then it is entirely possible that we will see the pair retesting 1411 and 1398.