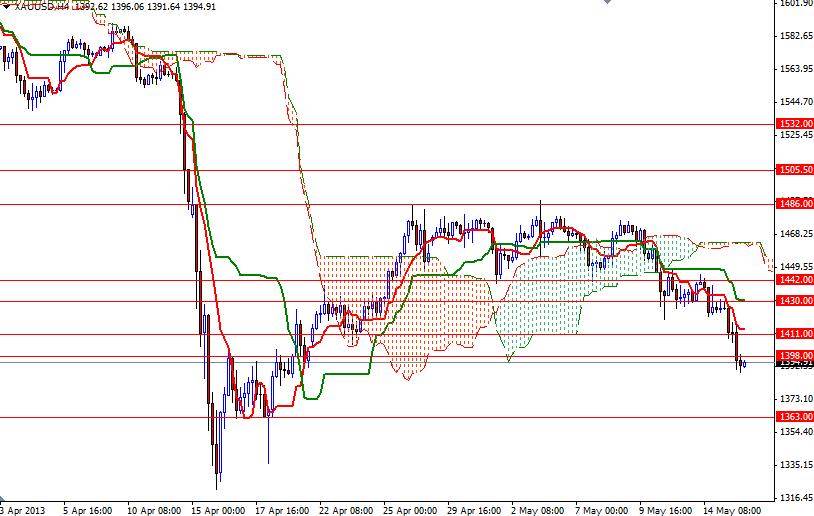

The XAU/USD pair fell for a fifth consecutive day as investor confidence in gold was eroded after the bulls failed to hold the prices above the 1430 level. Gold closed the day at 1392.75 and this is the lowest settlement in almost four weeks. The pair had been trading in a flat channel for the past two weeks and breaking below the 1442 support had indicated that higher prices were rejected by traders. In my previous analysis, I was telling that the technical outlook remained bearish and based on the measurements the bears would be targeting 1398 in the near future. Well, now we are back to this level, even breached that floor. There is a minor support at the 1386 level which may trigger some profit taking. Because of that, we may see prices revisiting 1408 - 1411 area before heading lower.

From a technical standpoint, a weekly close below 1398 will suggest that the bulls run out of gas and reinforce the idea that the recent price action is more than a simple correction. The key levels to watch today will be 1386 and 1411. If the bulls successfully defend the 1386 support level and prices head north there will be resistance at 1411, 1421 and 1430. If the bears clear the support at 1386, there is little to slow down the bears' progression until 1363. Right now, there is more resistance to the upside and the XAU/USD pair will remain bearish until prices climb above the Ichimoku cloud and the Tenkan-sen line (nine-period moving average, red line) crosses above the Kijun-sen line (twenty six-day moving average, green line).