The XAU/USD pair declined for a sixth straight session but found some support above the 1363 level. Gold prices traded as low as 1369.72, a four-week low, before recovering to 1388. The American dollar lost some strength as the data came out from the world's biggest economy disappointed the markets.

According to Labor Department figures, the number of Americans filing first-time claims for unemployment insurance payments increased by 32000 to 360000. Data released by the Federal Reserve Bank of Philadelphia revealed that its manufacturing index dropped to -5.2 from 1.3 in April and the Bureau of Labor Statistics reported that the consumer price index decreased 0.4%. Although weaker-than-expected data triggered some profit taking, comments from John Williams, President of the Federal Reserve Bank of San Francisco, limited market participants' reaction. He said the Federal Reserve could begin to ease up on its loose monetary policy by the summer.

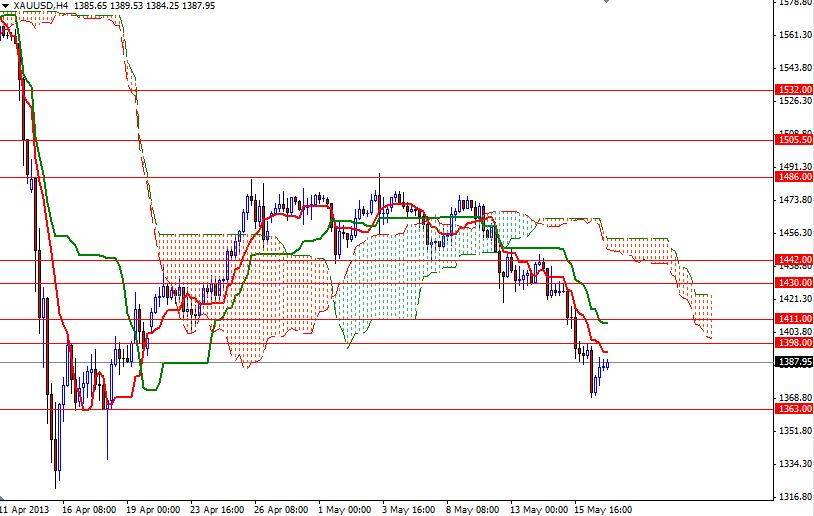

The price action we saw back in April (breaking below the 1530 level which was the bottom of a giant consolidation area) was an important event on a technical basis and it makes me believe that until the conditions in the marketplace change, the bears will be dominating the gold prices in the midterm.

On the daily and 4-hour time frames, prices are still below the Ichimoku clouds and we still have bearish Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty sixday moving average, green line) crosses. From a purely technical point of view, any pullbacks towards the Ichimoku cloud could provide nice selling opportunities in this market. If the bulls encounter heavy resistance and fail to break above the 1398-1400 area, I think the XAU/USD pair will be testing the supports at 1363, 1356 and 1349. On the other hand, breaking above 1400 could signal a run up to 1411 or higher. If that is the case, expect to see more resistance at 1420 and 1426.