By: DailyForex.com

The XAU/USD (Gold vs. the American dollar) pair continued to sink after a report released by the University of Michigan showed its consumer sentiment index rose to 83.7 from 76.4. After falling for seven days in a row, gold prices settled at $1355.57 an ounce on Friday, the lowest settlement since April 16. The American dollar got a lift after San Francisco Fed President John Williams said that the central bank might be able to start to trim its bond purchases by the summer. In addition, recent data out of the United States and Eurozone showed that inflation is under control in both regions. It appears that data releases are starting to become a dominant force in the markets again.

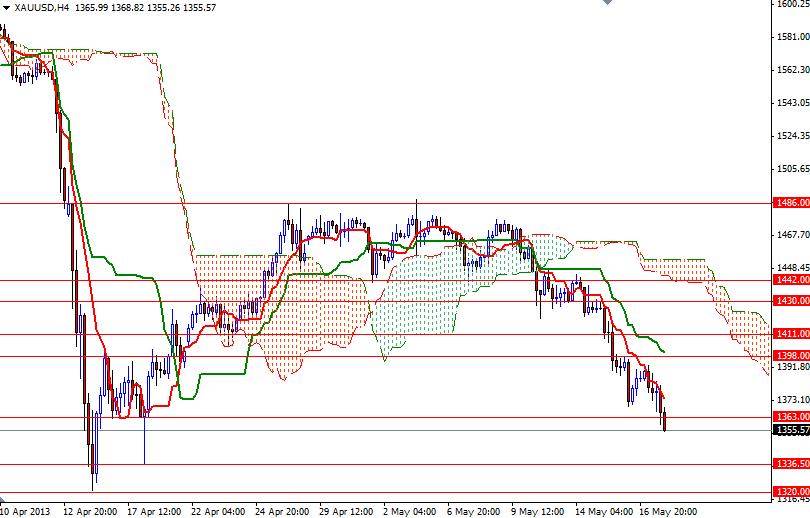

As a result, strong U.S. data will reinforce expectations that the Federal Reserve might end its bond-buying program before the end of the year. Gold prices have been under a relentless selling pressure since we broke below the 1532 support level which had been a bottom for the past 2 years and this extremely bearish technical formation on weekly charts suggests lower prices could be on the way. Now we are back below the 1398 support level and if the bears continue to dominate gold prices, based upon the measurements, I think we will see 1266 printing on the charts. On its way down, expect to see support at 1336, 1320 and 1308. If the pair pauses its free-fall, there will be resistance at 1363, 1378 and 1398. Until prices break above the Ichimoku cloud and the Tenkan-sen line (nine-period moving average, red line) crosses above the Kijun-sen line (twenty six-day moving average, green line), signs of weakness will be sold by me.