The XAU/USD pair closed the day higher than opening but remained within the last 5 days trading range.

Gold gained some ground against the American dollar although the data out of the United States were better than anticipated. The report released by the Labor Department showed that initial jobless claims dropped by 23K to 340K and the Commerce Department said sales of new homes rose 2.3% to an annualized pace of 454K homes from 444K.

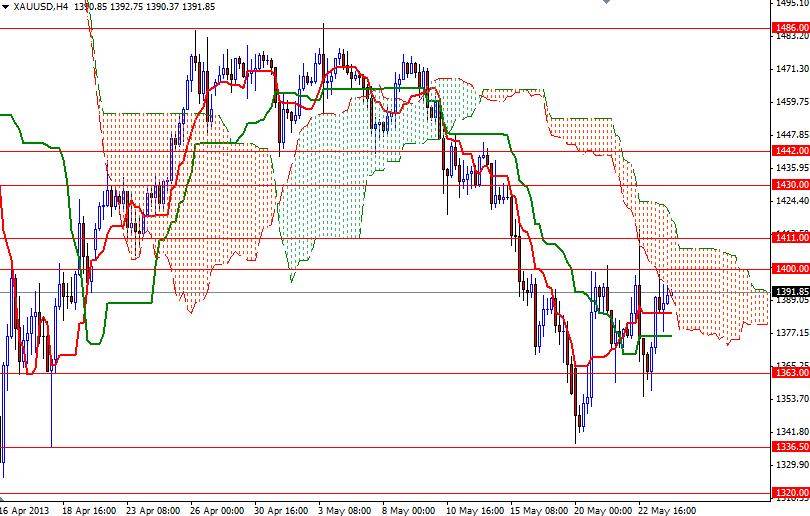

The markets are trying to digest the short term implications of the testimony by Federal Reserve Chairman Ben Bernanke on Wednesday. In the meantime, I think the greenback will be heavily influenced by stock and bond markets. Yesterday the USD/JPY pair and Nikkei fell precipitously. Nikkei seems to be steadying during the Asian session but I will keep watching the major stock markets closely. A sizable correction in The U.S and Japan stock exchanges might lure some investors back to gold. From an intraday perspective, expect to see resistance between the 1400 - 1411 area and support between the 1376 - 1363 area.

Prices are moving inside the Ichimoku cloud (4-hour chart) and this suggests that we are going to be range bound in the near term. If the bulls manage to break and hold above the 1411 level, it is likely that we will be testing 1430 and then 1442 (which converges with the bottom of the Ichimoku cloud on the daily time frame). If the pair encounters heavy resistance and breaches the 1363 support level, we will eventually test the bottom of this consolidation zone at 1354.50. A weekly close below this level would be highly negative. If that happens, I will be looking for 1336.50 and 1321.50.