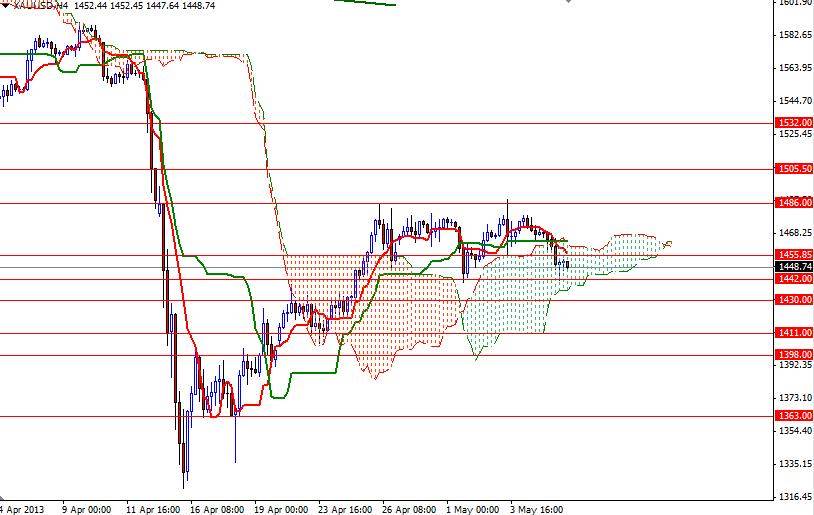

Gold prices continued to fall yesterday as the bulls failed to overcome the resistance level at 1486 to gain more momentum. It seems that major investment companies and funds are reluctant to buy gold after last month's sharp drop, which caused prices to break out of a massive consolidation area. From a purely technical standpoint, breaking below the 1532 support was a significant bearish event and therefore big market players prefer to build up short positions while we are approaching to stronger resistance levels. Yesterday the Reserve Bank of Australia joined other major central banks pursuing loose monetary policy but that didn’t do much to help gold. Today gold prices are hovering just above a critical support level of 1442. Since the XAU/USD pair is trading within the Ichimoku clouds on the 4- hour time frame, we may see some support at this point.

However, technical factors aside, heightened appetite for more conventional assets such as stocks could limit gold’s potential upside. The Dow Jones industrial average closed above 15000 and the Nikkei hit 14250. Only a very strong correction in U.S. and Japan equities might prompt funds to get back into gold. Technically speaking, a sustained break above 1486 would cause the charts to turn bullish. If that happens, I will be looking for 1498, 1505 and 1532. To the downside, I expect to see some support in the 1442 - 1438.50 zone. If this zone breaks, and we fall below 1430, support will probably be found at 1411 and 1398. Breaking below 1398 would confirm that the bears are firmly in control.