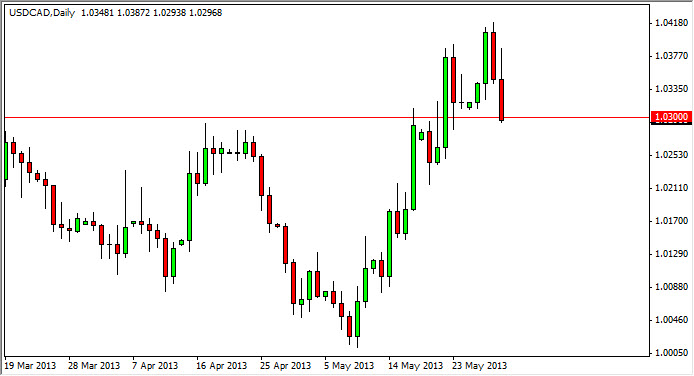

The USD/CAD pair tried to rally during the session on Thursday, but as you can see it turned around completely and broke through the 1.03 level in order to test the support that could be the catalyst for this market to head higher. This market has a significant amount of support below, but the 1.02 level below is what the market will have to show me in order to start selling as I think the next 100 pips or so should be that supportive.

As far as the upside is concerned, I think that the 1.04 level is the major hurdle that we have to get over, and as a result I think that a bounce will certainly struggle at that point. However, the market has been very coming to the US dollar lately, and as a result we could see a nice bounce from this point in time. I think that this market could go as high as 1.10 overall, but needless to say won't necessarily be a straight journey up to that level. Of course, is possible that we break down below the 1.02 level, and this of course could see the market head towards the parity level.

Watch the oil markets

Below markets will be a great influence on this market, and as a result I think the you would have to watch the WTI market in order to grasp what the USD/CAD pair could do. This market will be choppy regardless of which direction we go, but if you are willing to deal with the volatility, I believe that this pair could see longer-term moves come into the marketplace soon. It has a long history of choppy around and then suddenly moving in one direction rather violently, and this type of marketplace that we have seen around the world is certainly conducive for that type of move.

If we did get below the parity level, this pair could fall apart but I really don't believe this is going to happen. I think that we will go higher, it's only a matter of time before we see the support needed.