By: DailyForex.com

AUD/USD

The AUD/USD pair fell drastically during the past week, and closed at the very bottom of the range. This market looks very vulnerable at the moment, and I think that we are going to seriously test the 0.9650 support level. The gold markets certainly aren’t helping the situation either. The strength of the US dollar will be a constant in the Forex markets in the meantime, and as a result the Aussie will certainly have its work cut out for it. The area is just below though, and because of this I think the market should

be watched closely.

EUR/USD

The EUR/USD pair fell for the week as well, and now looks set to test the 1.28 level in the short-term. The Euro has its own special set of problems, and the strength of the US dollar – and by extension the US economy – should continue to keep this pair on the back foot. Rallies will be selling opportunities in my opinion, and a break of the 1.27 level will send this pair plunging. On the upside, the 1.30 level should continue to offer resistance, and as a result I think this pair will be somewhat tight for the long-term trader, but the summer months are coming anyway – a time that is typically quiet.

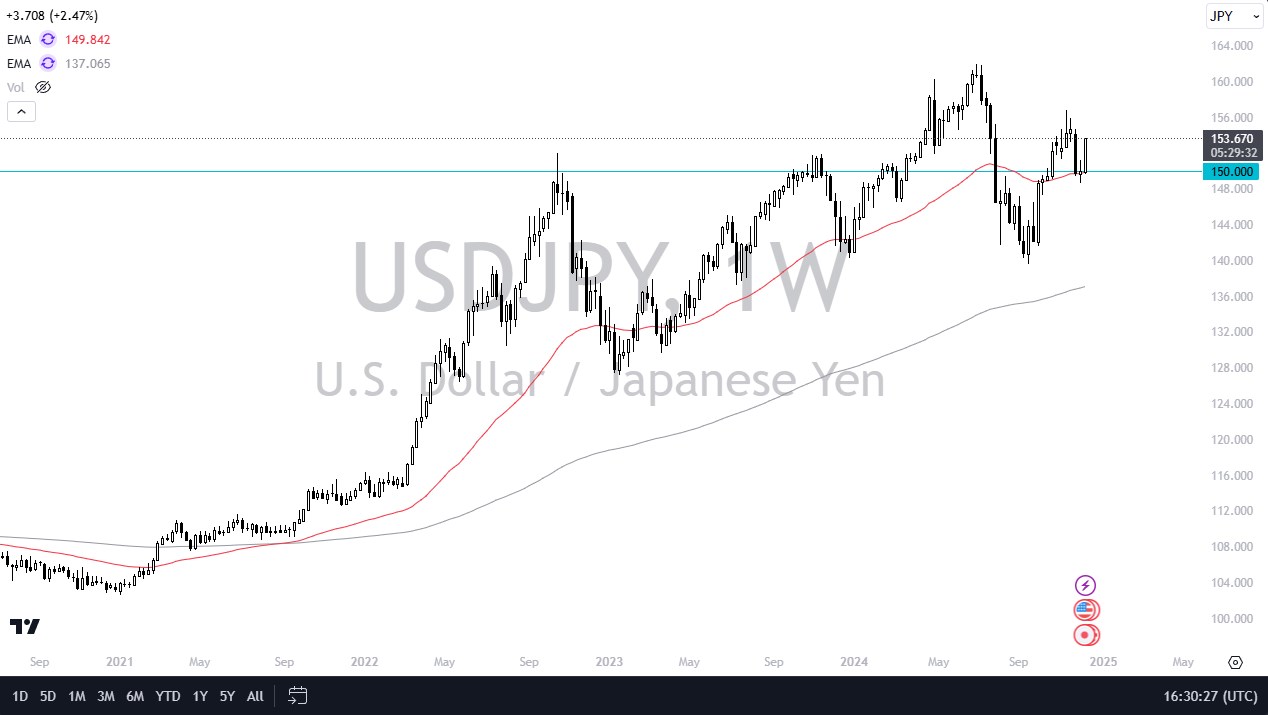

USD/JPY

The USD/JPY pair kept going higher for the week, and it now should be obvious that the pair is heading higher over the long-term. (As a side note, I have seen over at Oanda that the majority of traders are still short of this pair! – the Forex Factory site confirms this.) This shows just how behind the move that the retail trader is at the moment. The market simply will continue going higher over time, and the Bank of Japan has just gotten started. I expect to see this pair at 110 in the next several months.

US Dollar Index

I normally don’t cover the US Dollar Index in these articles, but I am including this futures contract to show just how strong the US dollar is at the moment. The contract is a “basket” of currencies against the US dollar, including the Swedish Krona, Euro, Japanese yen, Canadian dollar, Australian dollar, British pound, and Swiss franc. The Euro is 40% of the market, so the EUR/USD pair has a great amount of influence. With the move in the USD/JPY, there is a lot of influence there as well. The 84 level has been broken for the first time in three years, and this is significant. I see a fairly clear path to the 88 handle at this point, and wouldn’t be surprised to see US dollar strength continuing for the time being. In other words: Long USD in general.