By: DailyForex.com

EUR/USD

This pair continued to grind sideways most of the week, as the range between 1.28 and 1.30 continued to hold the market. The pair looks as if it will have a larger range between the 1.28 and 1.32 levels, perhaps trying to carve out the “summer range” as liquidity will dwindle during the holiday season.

Because of this, I think that longer-term traders are going to be hurting for something to do in this market. The market will offer decent shorter-term opportunities, but the long term trader will be left in the cold it appears.

AUD/USD

Think of a man standing on a ledge in the Grand Canyon, and you have a visual on what is going on in the AUD/USD pair. The 0.9650 level is massive support on the longer-term charts, and this is exactly where we ended the week. The Aussie continues to look very weak, and if we get a close below the 0.9650 level on the daily chart – we could see 0.90 soon.

The upside seems a bit of a different story, and I believe that the market will struggle with the parity level even if we do get a bounce. However, a daily close above parity is a bullish sign that would have me aiming for the 1.06 level again.

GBP/USD

The GBP/USD pair went back and forth during the week to form a very neutral looking candle. The market seems to be a bit confused at the moment, but the 1.50 level is the largest number in the vicinity, and I am waiting to see a daily close below that number in order to start selling. This pair might be a bit choppy in the short-term, but I think that a simple break on either side of this weekly candle will point the way forward.

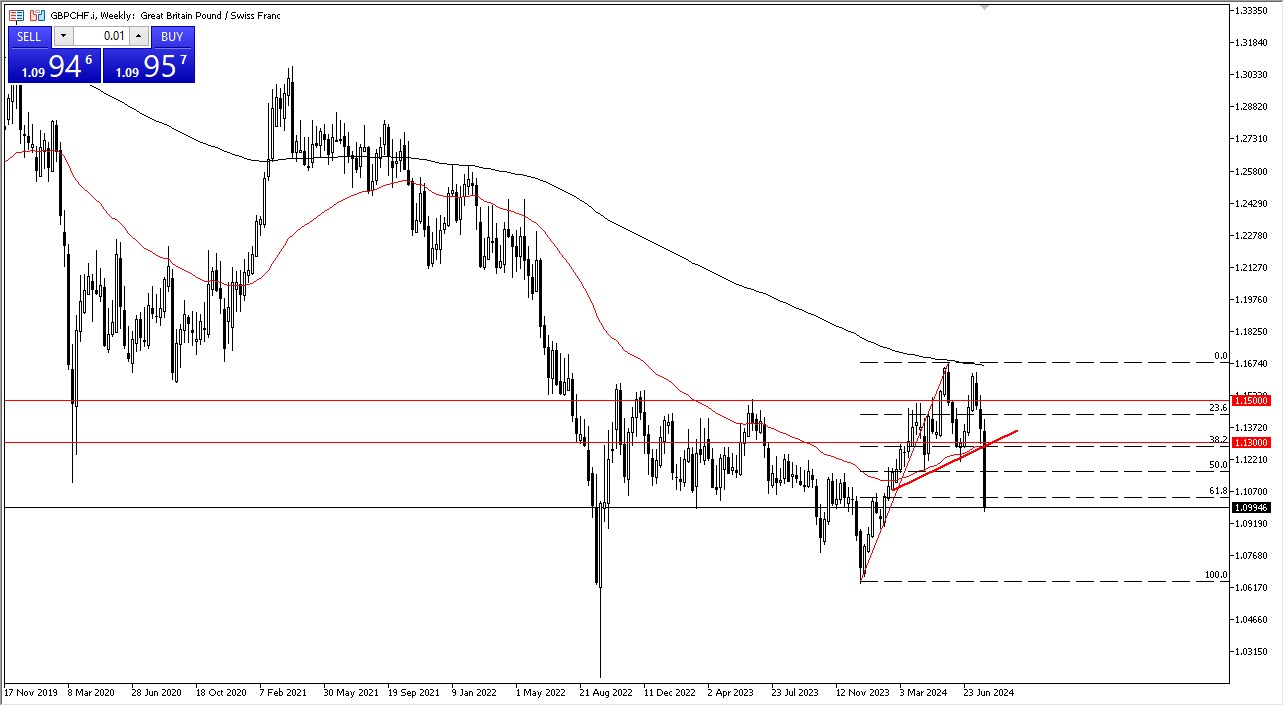

GBP/CHF

The GBP/CHF pair fell during the week as well, but it stopped on a dime, so to speak. This market found support at the obvious spot of 1.45, and now it is going to be worth watching the area for future direction. The area should offer support, and because of this I think that a bounce could be coming. However, we will have to see what the Monday candle does first in order to ascertain that information. Nonetheless, this looks like a classic “break out, pull back, and continuation” move.

.jpg)

.jpg)