EUR/USD

This pair continues to grind around in a relatively tight pattern. It is because of this that I feel that this market cannot be traded for anything more than a short-term trade. As such, the weekly forecast will remain choppy at best, and directionless. In order to break out in either direction, the 1.3250 level needs to be overcome on a daily close, or a move below the 1.29 level will have to happen. Until then, expect this to be a scalper’s market.

There are simply far too many headwinds to this pair taking off. The headaches in Europe continue, and the Federal Reserve continues its war on the value of the US Dollar. As long as we have this kind of environment, this pair is going to be difficult to say the least. If you wish to trade the Euro, do it against something besides the Dollar.

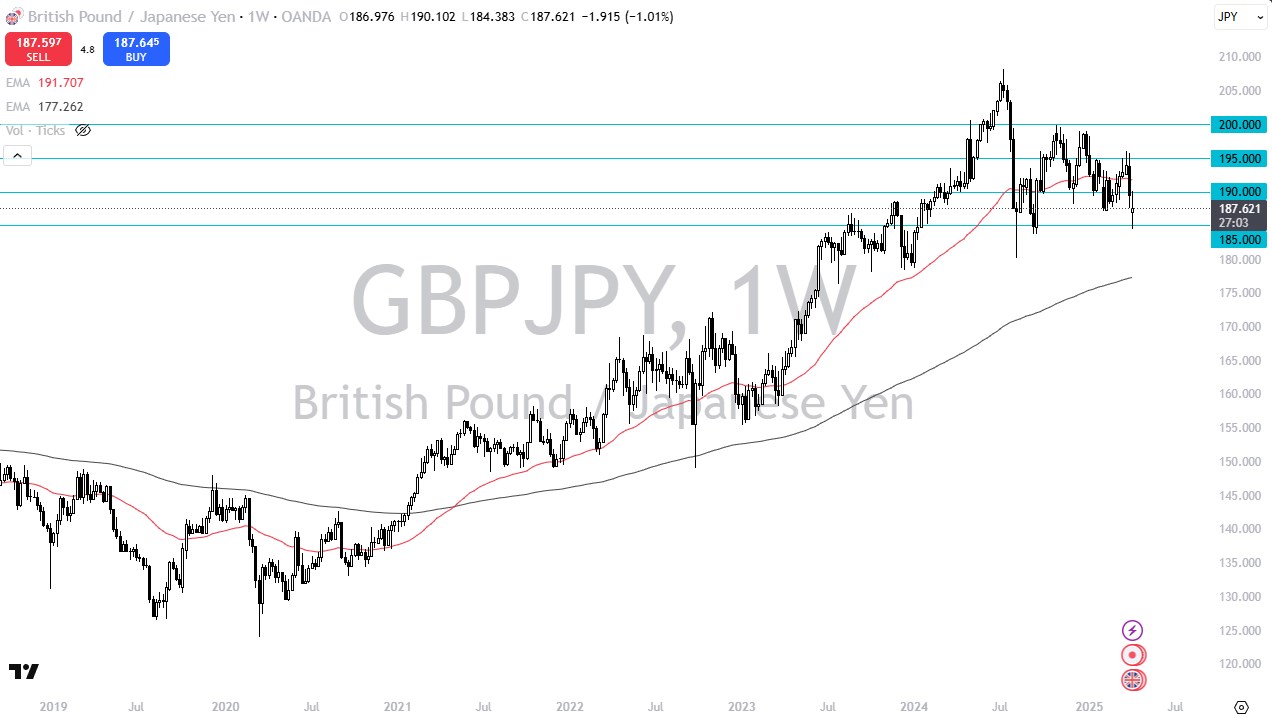

GBP/JPY

While the world worries about the USD/JPY, this pair has quietly broken higher. This pair has two things going for it at the moment: the British pound has been given a reprieve due to the fact that the United Kingdom didn’t fall into a “triple dip recession”, and the fact that the Bank of Japan is working against the Yen. Because of this, the move above resistance this week wasn’t a big surprise. Expect this pair to be a “buy on the dips” market for some time to come.

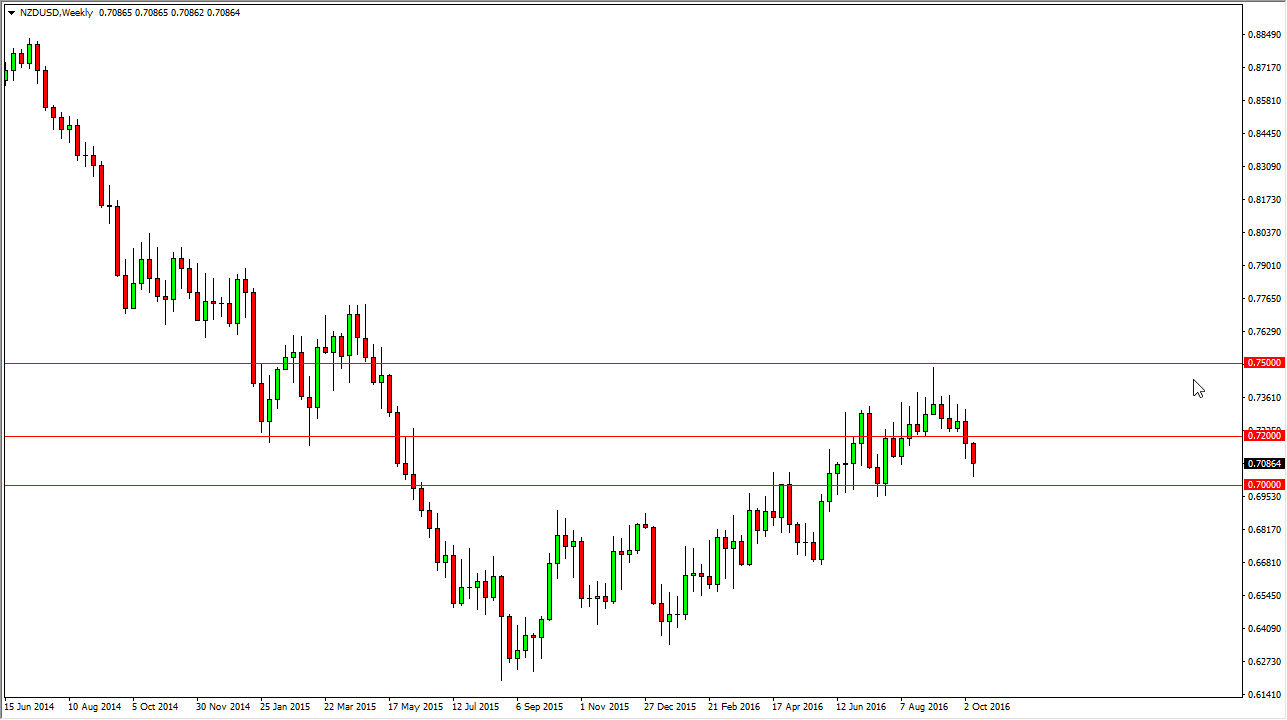

NZD/USD

The Kiwi Dollar had a back and forth week, but the reality is that we remain fairly comfortable above the 0.85 level now. This area had been serious resistance, and the fact that the market is alright with being above it tells me that we are going to go higher sooner or later. With this in mind, I am more than happy to buy this market going forward. I think that this pair will eventually look for the 0.95 level over the next year or two, and the recent action hasn’t hampered that thought.

USD/CAD

The USD/CAD pair fell during the week, and the pair found itself closing below the 1.01 level for the first time in a couple of months. With this being said, it is difficult to be bullish of this market now. The Friday Non-Farm Payroll numbers were strong to say the least, and as a result the Canadian dollar should start to gain again, but there is a certain amount of support at the parity level, and as a result I think that a daily close below that level will be a big deal.