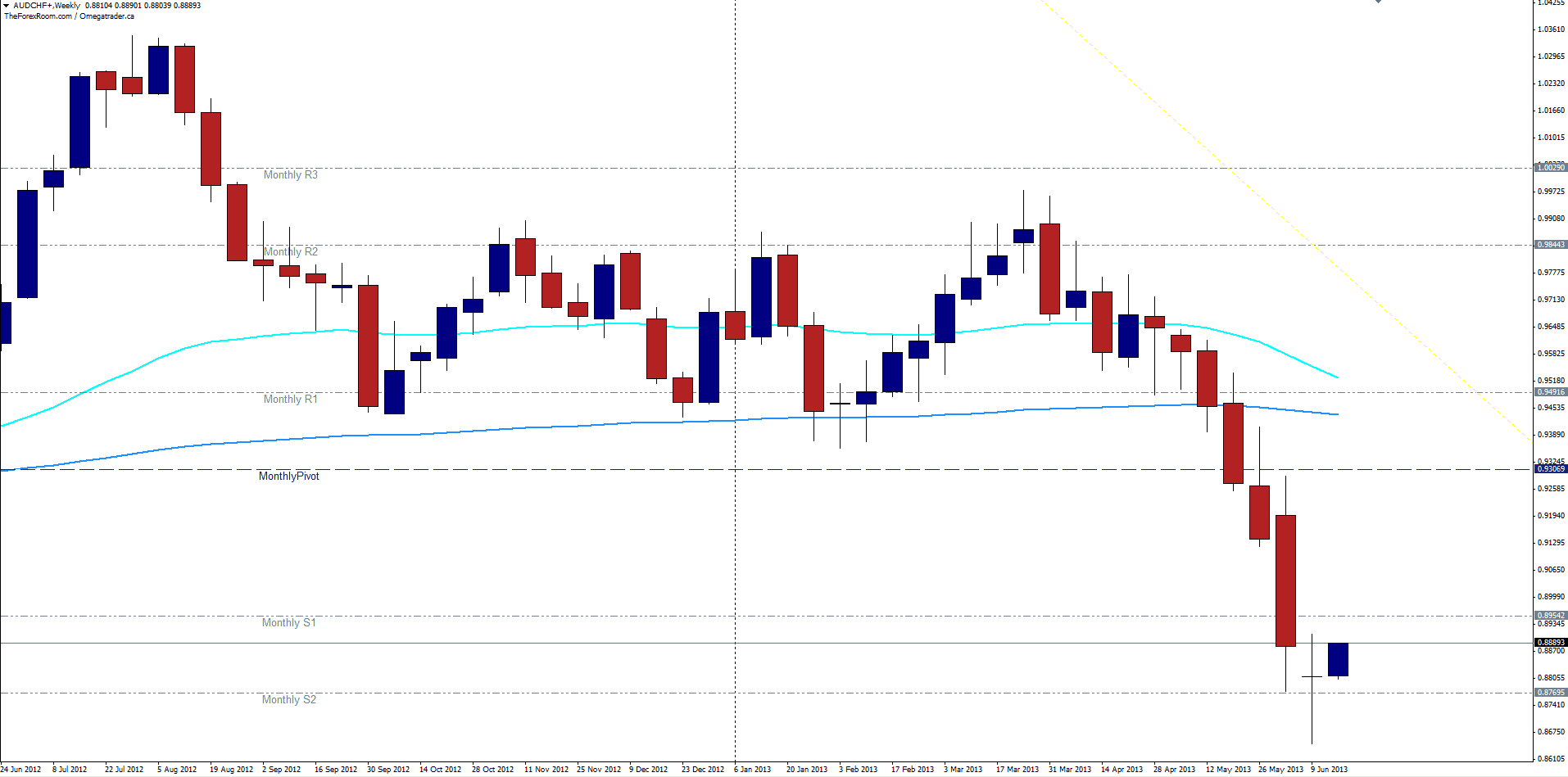

The AUD/CHF printed a Weekly Doji or Pin Bar of sorts last week on a support zone that has propped the pair up several times before. Falling to a low of 0.8648 before rebounding and closing at basically the same price the week opened at the pair has been climbing since the markets re-opened and may clear last week’s high very soon. If that happens, and a daily candle closes above 0.8900 (Last week’s high was 0.8910) there is a good chance we could see this pair fill the technical vacuum between 0.8900 and February’s lows at 0.9356. There is little in the form of support or resistance within this ‘vacuum’ hence the term, with the first real resistance hitting the bulls at around 0.9100 and again at 0.9240. Should prices fall and break last week’s low however, there is also little support below the last week’s support level at 0.8770 aka the Monthly S1. Breaking last week’s low could bring a retest of the July 2011 lows around 0.8092.

AUD/CHF Heads Higher, June 17, 2013

By Colin Jessup

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox. Please enter a valid email address

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown. - Labels

- AUD/CHF