By: DailyForex.com

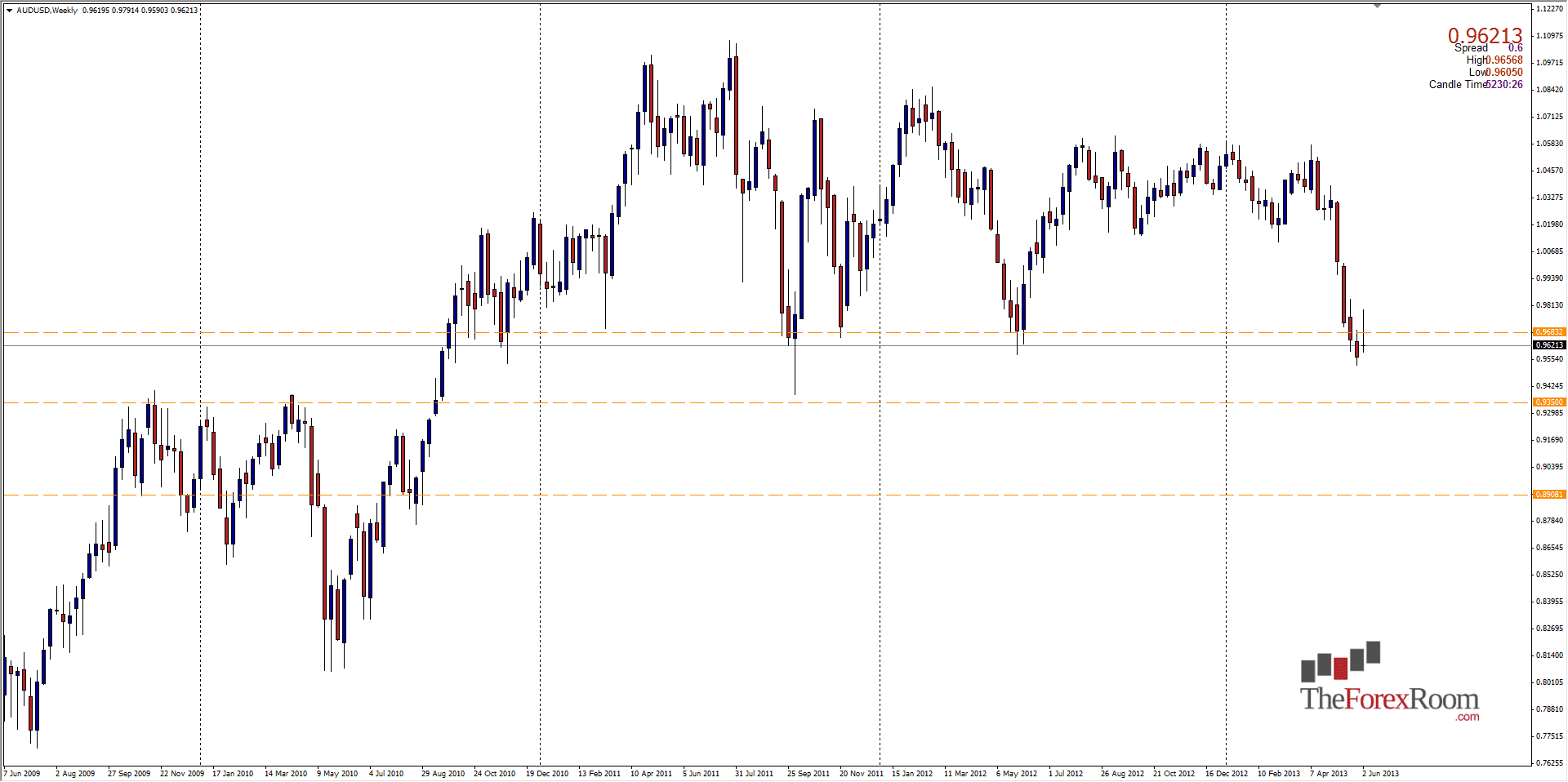

The AUD/USD has certainly fallen from grace, so to speak. The Aussie Dollar has been one of the 'go to' currencies as investors have relished its resilience and strength throughout all market conditions for the last few years. Now, the currency of the largest 'island' in the world has close below 0.9600 for the first time since September 2011 on a weekly time frame and finds itself struggling to recover. Yesterday while other currencies such as the EURO and British Pound stayed relatively flat, the Australian Dollar fell another 160 pips give or take a few pips. If last week's low breaks, and especially if we see a daily close below last week's low of 0.9527, there is the strong possibility that 0.9350 will be the target as this is really the only resistance to speak of. The 0.9350 area is established support from 2009/2010. If however we see a daily candle close above 0.9800 the bears may be exhausted and let the bulls take back the streets. Should this happen they will have a relatively clear shot back up to parity as the pair fell so rapidly and consistently recently that it wiped out almost all support/resistance barriers.

Happy Trading!