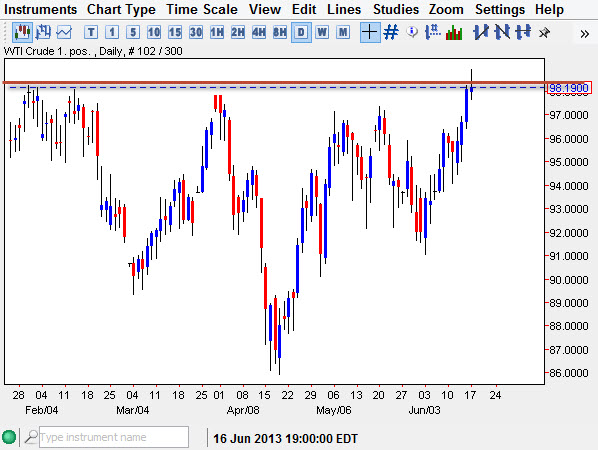

The WTI Crude Oil market rose during the session on Monday, breaking well above the 98.50 level at one point during the session. However, as you can see the market fell from that high, and a pullback in order to form a shooting star. This suggests that the $98.00 level is going to become very important in this market. It should by all means act as support going forward, simply because it was resistance previously. The fact that the market is sitting on top of that suggests that a breakdown will be significant if that happens.

On top of that, I see quite a bit of noise above the $99.00 level so I think that the market is going to struggle to get to the $100.00 level during the next couple of sessions. I believe that the oil markets are a bit extended at this point in time, and a return to the previous consolidation area wouldn't exactly be a major surprise. After all, it is hard to justify extraordinarily high oil prices at this point in time.

But wait, there's an argument to be made for the other side…

Another thing that I noticed on this chart is the fact that the current level appears to be the neckline of an inverted head and shoulders pattern. Because of this, I think that there is the potential for explosive move higher, but quite frankly we need some type of catalyst to move the market in that direction, especially with that ferocity. This being said, I believe that the candlesticks for the Monday session is probably a signal that the inverted head and shoulders may not fire off. If that's the case, then we will simply go back to a grinding sideways market overall. Quite frankly, that's how this market has behaved for most of 2013. This of course makes it very likely, and as a result this is what I expect. However, you always have to keep your eyes open to all possibilities, so pointing out the inverse head and shoulders was of course the appropriate thing to do, and is something that you should keep in the back of your mind.