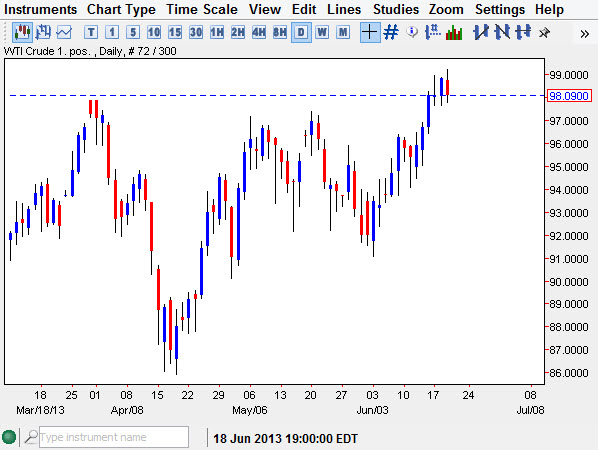

The WTI Crude Oil market initially tried to rally during the Wednesday session, but as you can see the $99.00 level offered far too much resistance. I have been suggesting for a while that resistance was deathly going to be strong in that vicinity, and extending up to the $100.00 level, as it is a large round psychologically significant number.

Of course, I would be remiss if I didn't mention the fact that the comments coming out of the FMOC meeting didn't of course have a significant effect on prices well. The Federal Reserve Chairman Dr. Bernanke suggested that perhaps the Federal Reserve will taper off of quantitative easing later this year, which of course the market already know. What he said next was of course much unexpected as he suggested that based upon current economic projections, the Federal Reserve could be out of the quantitative easing game by the middle of 2014. This is a full year before the market had anticipated.

Candle shape, and place make me think a pullback could be coming.

The shape of course is a bit like a shooting star, although it isn't perfect. The candle does suggest weakness, and it is exactly where I would like to see it. Because of this, I think that if we managed to break down below the $97.50 level, this would break the supportive action that we have seen over the last three sessions in a row, and suggests that we are going to reenter the previous consolidation area.

The fact that the US dollar should now find strength going forward suggests to me that this will happen. However, the simplest way to lose money trading is to try and anticipate a move. I need to see that breakdown in order to start selling. In the meantime, I will be on the sidelines as I certainly won't be buying the WTI market just underneath the significant $100.00 level either. Nonetheless, I do expect a move relatively soon, and will simply wait to see it happen, and then take the appropriate action...