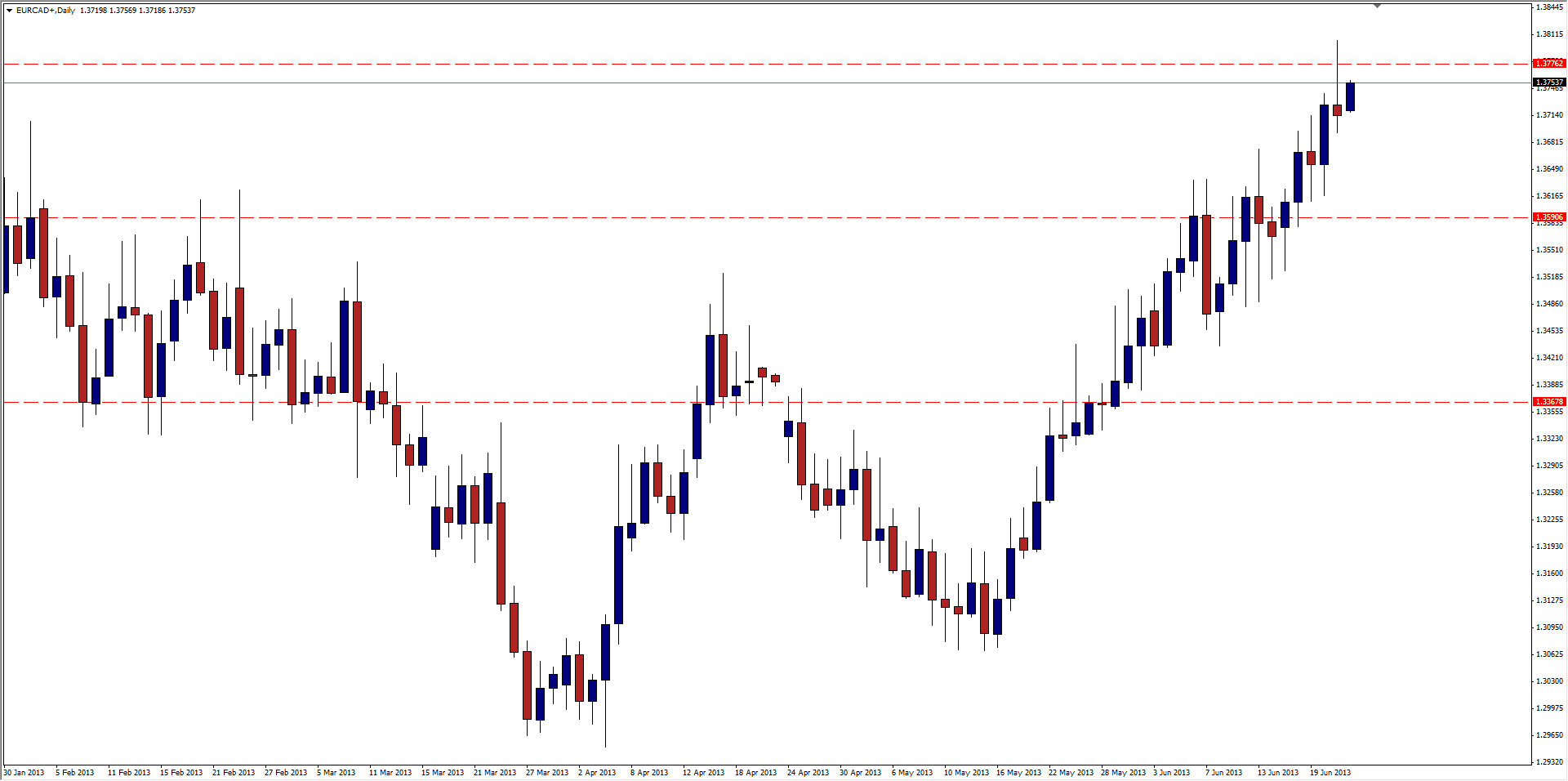

The EUR/CAD closed Friday off as a Pin Bar Reversal at an area of previous highs & lows, 1.3775. The zone has been a turning point in the past, so will the pair turn bearish at this level again? The set-up is a very bearish one in itself, suggesting from price action alone that we could see this pair drop today or tomorrow but the trend is certainly Bullish. There are some key points in favor of the bears in addition to the previous highs/lows, such as the convergence of 2 key Fibonacci levels, the 161.8% Extension for the bearish swing between April’s high and May’s low, and a 138.2% Extension from the January 2012 high to August 2012’s low. There is enough information in favor of the Bears to say that should Friday’s low break, we could see the bears push it down to the next key zone at 1.3590 as well as a good argument for a further push to the 61.8% retracement at 1.3365. If the high is taken out first however, there is a possibility that 1.3950, a key level for the pair from October 2010 to December 2011, will be achieved. Follow that up with a potential serious bull run to 1.4180, the 38.2% retracement from October 2008’s high at 1.7508 to the all time low set in August 2012 at 1.2128.

EUR/CAD Facing Resistance

By Colin Jessup

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox. Please enter a valid email address

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown. - Labels

- EUR/CAD