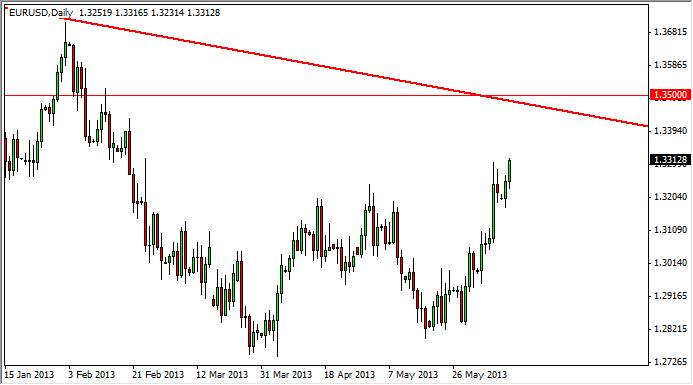

The EUR/USD pair had a positive session on Tuesday, initially falling slightly, but as you can see it broke the recent high in order to close above the 1.33 handle. As you know, I personally do not like the Euro at all, but the market is going higher and that is simply all I need to know. On a break of the highs from the session on Tuesday, I will be buying this market for a short-term gain. As you can see on the chart, I have a red trend line going lower, and this is based upon a longer-term weekly chart going back several months.

Remember that there is a German High Court decision coming out over the next 24 hours, but in reality the real question is whether or not they will actually do something to derail the Euro itself. They have shown themselves willing to bend to the will of the market in the past, so will be interesting to see whether or not they choose to suddenly find the wherewithal to buck the trend. I don't think they will, but in the end it really doesn't matter as I am simply a technical trader anyway.

Expect significant resistance near the 1.34 level.

Because of the downtrend line, and the fact that there is a cluster at the 1.34 handle, any long position that I initiate in this general vicinity will be a short-term trade only. I don't trust the Euro, as there are simply far too many possible headlines to come out of that region to derail the currency. The market simply have not sat still long enough to hold onto trade, and as a result I am finding that the volatility has made trading a short-term endeavor for everyone. There are no trend traders enjoying this market right now.

Going forward, I expect to see this market continue to go higher for the short term, but to find significant resistance above and probably grind its way back down to the 1.32 handle. Over the length of the summer, I expect choppy conditions at best.