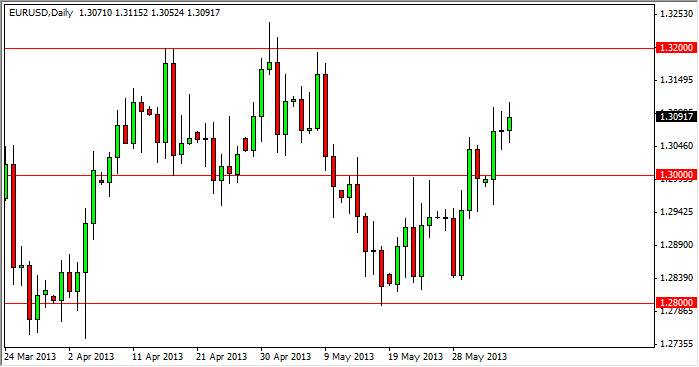

The EUR/USD pair had a positive showing on Wednesday, as the 1.31 level was overtaken during the session. However, we are approaching the nonfarm payroll Friday, which of course normally means of the markets will quiet themselves for roughly 24 hours ahead of time.

I still believe that this market is essentially stuck between the 1.30 and the 1.32 levels on the upside, as the consolidation continues. This is a very choppy market to deal with at the moment, and as a result it is one that cannot be traded for more than a short-term gain or loss.

In fact, I do not believe that until we break above the 1.30 level that you can buy-and-hold this pair at all. On the downside, if we managed to break below the 1.28 handle, we could see significant selling, which could have you holding onto a sell position as well. However, in between those two areas we have to consolidation area's that form one larger one, and that's essentially what we've been stuck in for quite some time.

1.30 is what I would consider "fair value."

Looking at these chart, I can see that the 1.30 level is the "middle point" of the larger consolidation area, which of course means that the market seems to be fairly balanced at that level. With that in mind, I believe that the market will simply chop around for the remainder of the summer, reverting back to the 1.30 level when things get a bit too stretched in one direction or the other. In fact, I believe that the 1.28 level on the downside is significant support on the longer-term charts as well, and will be very difficult to break down. To be quite honest, I don't see it happening anytime soon.

This of course could changes some type of headline comes out of Europe involving the European debt crisis. In the meantime though, it appears that the markets are completely capable of looking past envisages, and because of that I don't think that is going to happen between now and the end of summer. In the meantime, keep your stop losses tight, and focus on the one hour charts.