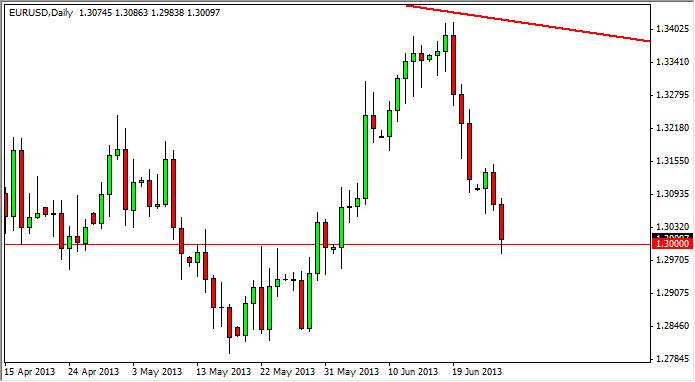

The EUR/USD pair fell during the session on Wednesday, slamming into the 1.30 level during the session. Obviously, the 1.30 level is a large, round, psychologically significant area which of course brings a lot of attention to the market participants. Obviously, you can see that the candle found support down in that area, and you can also see that there is a lot of clustering all the way back down to the 1.28 handle.

Going forward, I suspect that this market will continue to face pressure, but I would not be surprised at all to see a bounce from the 1.30 level, as the fall has been very significant over the last week or so. The markets should offer selling opportunities all the way back up to the 1.34 level, and it isn't until we get above that area that I consider this market one that can be bought and held onto. Quite frankly, this market will more than likely continue to be choppy and aggravating like it has been for well over a year now.

Interest rate differential

The interest rate differential obviously is one of the main drivers of this market, and as a result I feel that this market will be highly influenced whatever the Federal Reserve members say in the near-term. Also, don't forget the European Central Bank can also have an effect on this marketplace, and the comments by people from that group of course have to be paid attention to as well.

In all honesty, I feel much easier about trading the Euro against other currencies than the US dollar. After all, the Euro can be traded against many other currencies, and as a result you should not overlook that. I know far too many traders it simply play the Euro against the Dollar, and therefore miss a lot of trading opportunities. I believe this is because of the small spread in this pair, but quite frankly the difference between two and five pips and a pair should be enough to change your trading habits. Going forward, I expect to see the Euro soften against all currencies, but for whatever reason, the EUR/USD pair continues to be difficult in general.