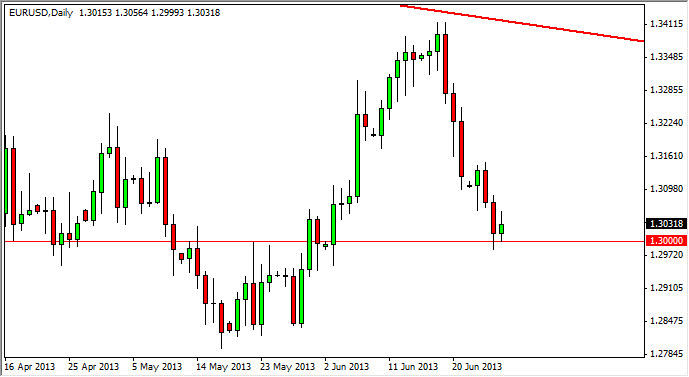

The EUR/USD pair bounced off of the 1.300 level during the session on Thursday, but quite frankly that's a major round number, which of course carries psychological significance. Because of this, I am not surprised at all that we found little bit of support in this area, but as you look at the daily candle it's easy to see that the rally that we did see was rather pathetic. At the end of the day, we have formed a shooting star sitting on top of support. This is always a bit of a tricky analysis for me, because it shows that there is indeed pressure to the downside, but we are also sitting on top of significant support. This often leads to very choppy and difficult conditions.

The Federal Reserve and European Central Bank will have to be monitored.

The Federal Reserve has rocked the markets from time to time with various statements, and this is the one currency pair that seems to really take it on the chin in one direction or the other because of that. With that being the case, I feel that this market will eventually get some type of significant bounce, simply because we've been following for a while. If you look at the longer-term charts you can see that it's been chop-chop for a long time, and should continue to be so. In the immediate future, I see the 1.30 level as being very supportive for the Euro overall, and this is especially true considering that there is such significant noise underneath down to the 1.28 handle.

That being said, I believe that the significant resistance will reappear and the 1.32 handle, which of course has been resistive in the past. We simply have to look back to the month of April, and you can see that this market has bounced around in this 200 PIP area before. Going forward, I can only suggest that we will more than likely see very choppy conditions, and this will be a short-term traders market at best.