The EUR/USD pair had a strong showing on Monday, mainly because of the weak economic numbers coming out United States. The PMI number been just under the 50 level of course suggests that there is contraction, and this of course had the markets concerned about whether or not the Federal Reserve is going to be able to pull back from quantitative easing. As a result, the US dollar lost value against almost everything in the world at that point in time, and of course the Euro was no exception.

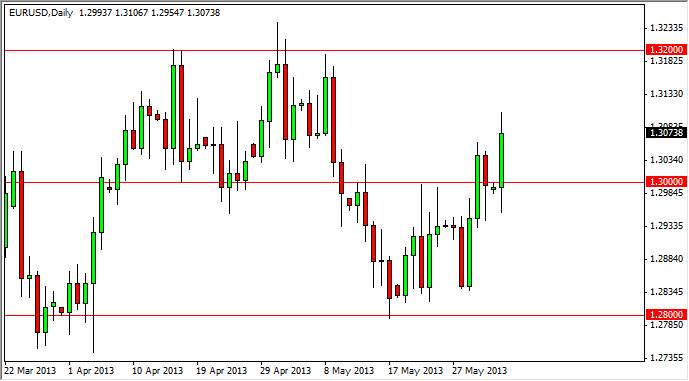

Look in this market, we are now in the upper half of the larger consolidation area, and as a result I believe that pullbacks will offer buying opportunities based upon shorter-term charts. Going forward, I believe that buying these pullbacks on charts such as the one hour or even the 30 min. time frames may be the way to go. I don't necessarily believe that we are going to make some kind of big massive move though, and I still believe that the 1.32 handle will be rather resistive.

Changing lanes

Its easy look at this market as simply changing lanes. It's a lot like going down the freeway, you have a couple of choices, but in the end you're going in the same direction overall. I believe that we have just entered a different lane, and now will bounce around in that area, which is roughly 200 pips wide. I don't think that we have the wherewithal to breakout above the 1.32 handle, especially considering that summertime is coming.

This pair will trade more off of Federal Reserve expectations than anything else at the moment. This was proven during the Monday session, in not only this currency pair, but all others as well as futures markets. After all, why else would the stock markets rise on the day that such poor economic news was received? It's because we are now in a "Federal Reserve watch" mode. What they do is the only thing that matters in the long run, and right now it does not look into the market that they are pulling away the liquidity anytime soon. However, be aware the fact that Friday is nonfarm payrolls day, and as a result we have a hard time believing that this market is going to take off in one direction or the other anytime soon.