By: DailyForex.com

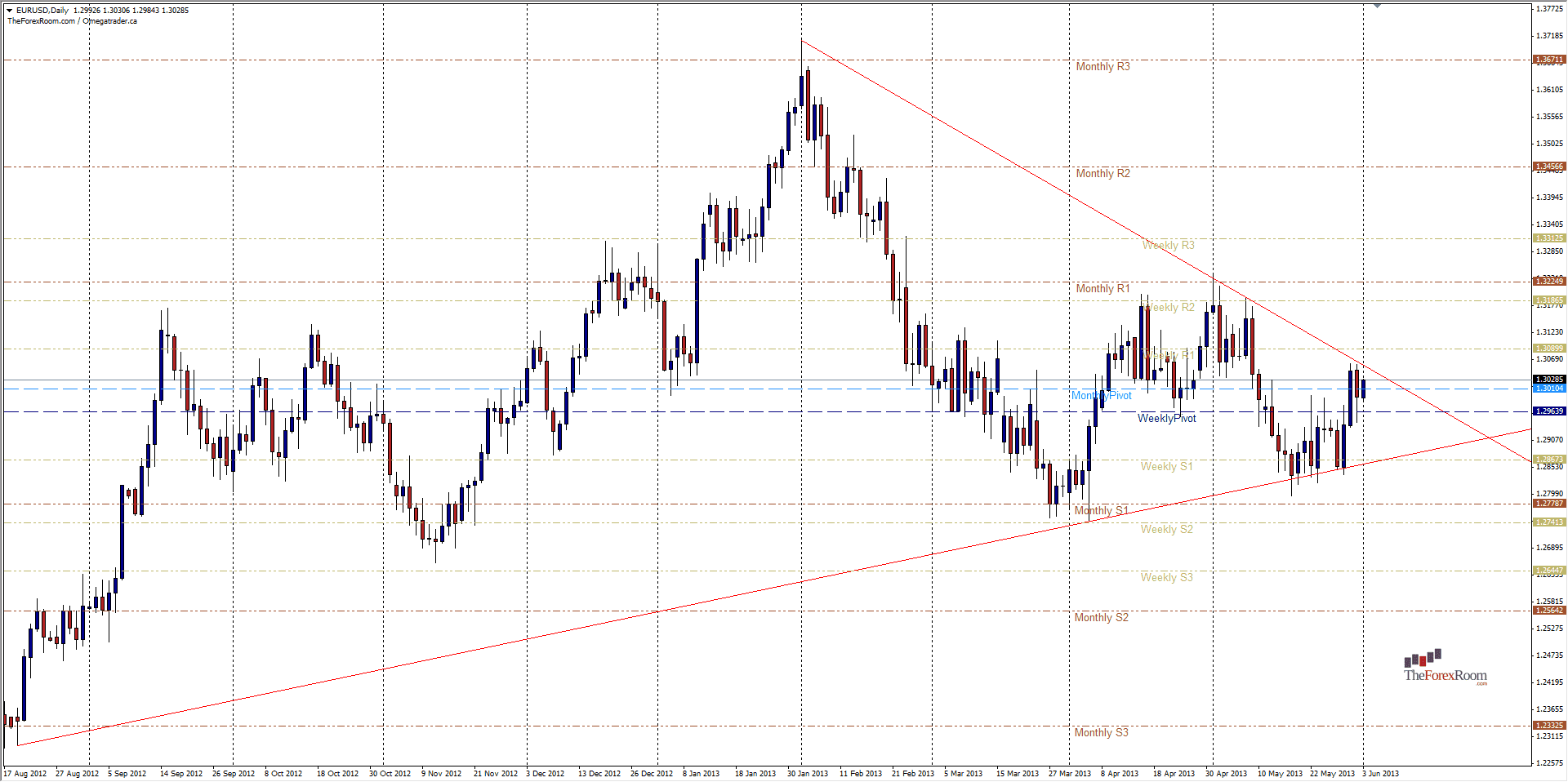

The EUR/USD on Friday printed what is known to price action traders as an 'Inside Bar'. This is when the candle on the right does not exceed the high or low of the candle on the left, so that it looks like it is literally 'inside' the bar to the right. This can be give traders a clue as to where price is headed, and in this case it appears to be Higher. If price were to break last Friday's high of 1.3059, there is a strong possibility that we will see price take another crack at 1.3100 and possibly very soon afterwards, 1.3200 where the pair found resistance throughout April and May. These levels really are the key to the EUR/USD gaining ground on the Greenback. Also of interest is that the pair has formed and ascending wedge pattern as you can see from the chart, and barring a false breakout the the top side this could be the big push higher that the EUR/USD seems to be working so hard for. And yet another pattern we can see on the daily chart is a Bearish Head & Shoulders Pattern, with a 'neckline' at the key resistance level of 1.3250. This is yet again a possible hint at where the EUR/USD is going for a close above 1.3225 on the Daily time frame will invalidate the Bearish pattern for the most part. However, false breakouts are common in the current market conditions and failure to break 1.3200 will bring resistance into play for the pair yet again at 1.3000, 1.2960 and 1.2860 with a daily close below the Monthly S1 at 1.2787 possibly indicating that the bears will win this round and we could see this pair retest 1.2500 in short order.

Happy Trading!