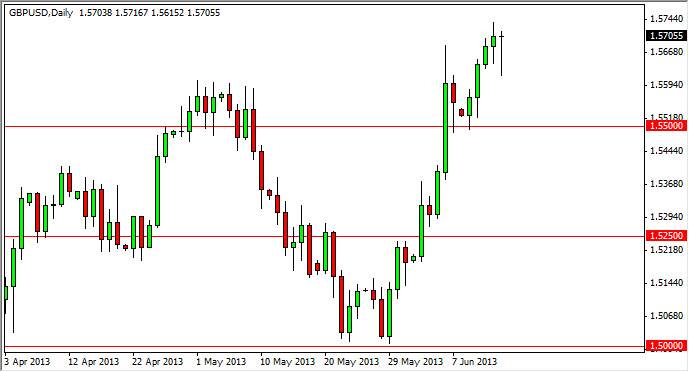

The GBP/USD pair fell most of the session on Friday, but as you can see bounced significantly from the 1.56 handle, an area that had been resistive back in the late part of April, early part of May. Because of this, we formed a nice looking hammer at the top of the recent and significant move higher. Because of this, I believe that the market is primed to go higher, and on the top of the candle for Friday being broken, I would be buying the British pound.

It makes sense that we will initially try to reach the 1.60 handle over time, although that will more than likely be significant resistance. On the other hand, I can also envision a scenario where we break down below the bottom of this hammer, which is normally a very negative sign. However, in this case I think that would only lead us to test the 1.55 handle for support. It really isn't until we get below that level that I can envision selling the British pound at this point time, simply because it is been so buoyant.

1.60 And beyond

It's possible that we not only get to the 1.60 handle, but we go much higher. It really comes down to the British economic numbers, which of course have been coming on a little bit better than anticipated, and what the Federal Reserve is doing. The latter of the two points there is probably going to be the most important one. After all, it seems that the entire Forex market is trading simply on what the Federal Reserve is going about the so-called "tapering" of quantitative easing.

With the FMOC statement coming out on Wednesday, we think that the future of this pair, as well as many of the other pairs around the Forex markets, will be determined by that statement. There are a lot of jitters about the Federal Reserve cutting back on its quantitative easing later this year, as the market has become addicted to cheap money. With that being the case, the next couple of sessions may be fairly quiet but we certainly have an upside bias.