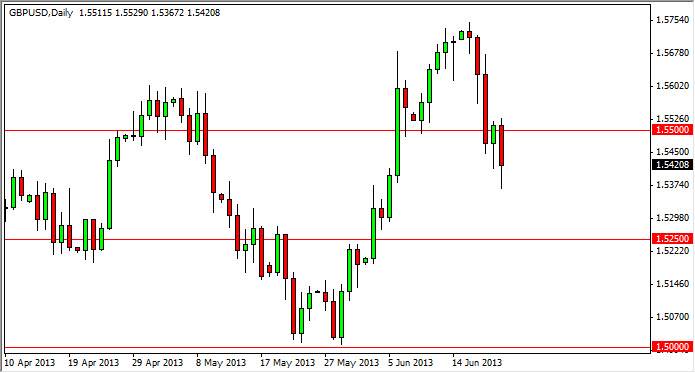

The GBP/USD pair fell during the session on Friday, which of course is very interesting considering we managed to not only fall, but we managed to break below the bottom of the Thursday hammer. This is a very negative sign, and the fact that we could not get back over the 1.55 level for any significant amount of time does of course make me think that this pair has more weakness coming.

Looking at this chart, I think that we are heading down towards the 1.5250 level in the short term, and possibly even lower. Nonetheless, I do believe that it's a somewhat tight market, and as a result I prefer to trade it on the short timeframe. It's going to be difficult to trade this market on anything bigger than the daily chart, and quite possibly the four-hour chart. Simply put, you need to have a little bit more room to run then we have, but we do have a very significant and obvious levels to work with.

Playing Ping-Pong

I believe that this market is essentially playing Ping-Pong at the moment, bouncing between a handful of different levels. Looking at the candle for the Friday session, to me it shows a breach of significant support, and at this point in time I would not be surprised to see a bounce to the 1.55 handle before serious selling comes into play. If that happens, I would be surprised to see sellers stepped in at 1.55 with significant strength, as the US dollar has been so favored lately, and should continue to be so.

On the other hand though, if we managed to break the bottom of the candle for the Friday session without pulling back, I think that's a sell signal as well. The real question will become whether or not we can get down below the 1.5250 level, as it should be significant support. Nonetheless, I am looking at selling the rallies until we at least break above the 1.56 level in this market, which at that point in time just signify how confused it really is.