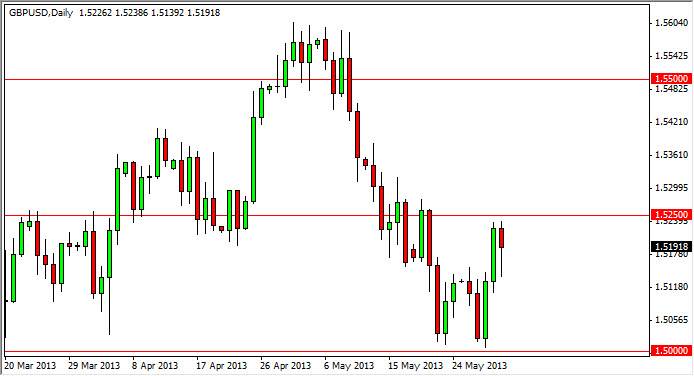

The GBP/USD pair fell during most of Friday, but you can see it found support at the previous cluster which topped out at roughly 1.5125 or so. That being the case, we bounced from that area and formed a hammer. This hammer is interesting because it sits just below the 1.5250 level, an area of significant resistance that could signal another leg higher if we can breakout from here. On top of that, the fact that we formed a hammer of course just adds to that significant.

The Bank of England has an interest rate statement on Thursday, but quite frankly there is very little expect out of it. After all, they have a new Governor coming into the fold in July, so it's hard to believe that they will front run anything he wants to do. That being the case, Thursday should be a nonissue, and we should continue to move in whichever direction the market wants to.

Suddenly, this pair looks like it has a bit of support left in it.

The 1.50 level has offered quite a bit of support in this marketplace, and in fact on the weekly chart we have formed two hammer candles in a row. This of course suggests that the 1.50 level is holding up for support, and because of this I think it's going to be difficult to break down below that level. In fact, we could be carving out of bottom for the near-term as we speak.

Obviously, a break below the 1.50 level is extraordinarily bearish in this market, but quite frankly we have really be on it and it is held up quite nicely. A break below that level could send this market the 1.48 and then much, much lower below that. On the other hand, this could be the buying opportunity the people have been waiting for as we continue to grind higher. It will simply come down to what the Federal Reserve and the Bank of England are doing in relation as far as quantitative easing. We already know that the US economy a stronger than the British one, so that of course has no bearing at this point.