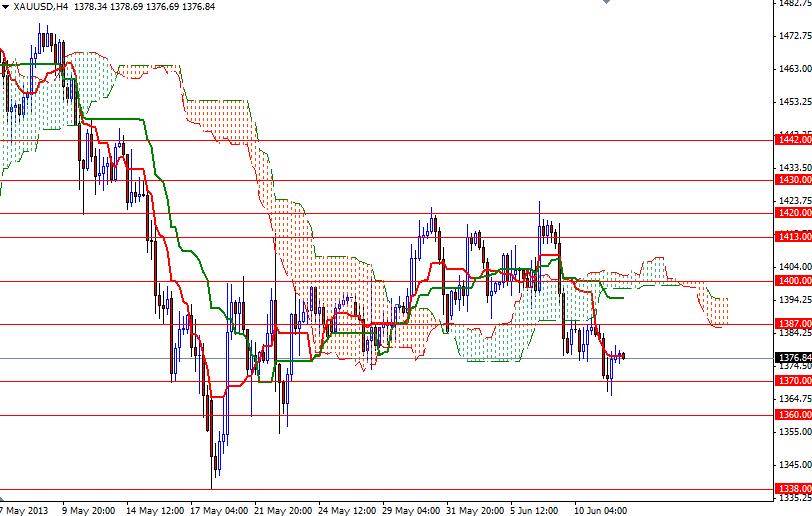

Gold priced ended yesterday's session with a loss as the technical selling pressure continued to weigh on the market. Standard and Poor's decision to revise its U.S. credit rating outlook to stable from negative was another element working against gold prices. The XAU/USD pair tried to climb above the 1387 level, which happens to be the bottom of a two week consolidation period, but encountered heavy resistance and traded as low as 1365.80. Although increasing physical demand, sizable purchases by the central banks and lower interest rates seem to be gold supportive, reports indicate that large institutions continue to bet on lower prices. It appears that big players are fixated on the U.S. Federal Reserve's future plans. Surveys show that majority of economists believe the Fed will reduce its asset purchases to $65 billion a month at its October meeting. I have been extremely bearish and suggesting that any pullbacks could provide selling opportunities since prices broke below the 1532 level, the bottom of a giant consolidation zone which the XAU/USD pair had followed more than 80 weeks. Based upon the measurements, the charts still suggest that 1266 is on the table. However, I am more cautious at this point. The major stock markets are losing strength and this situation (if gets worse) might prompt funds to get back into gold.

Today the key levels to watch will be 1387 and 1370. If the bears continue to dominate the pair and push prices back below the 1370 level, there is a possibility that the bearish trend will resume and the bears will be challenging the bulls at 1360 and 1354.50. If the bulls successfully break above the 1387 resistance level, we may see a bullish attempt to retest the 1400 level. A close above 1400 would give the bulls enough power to tackle the 1408/13 zone.