The XAU/USD pair closed the week higher than opening as the American dollar lost some strength after economic data out of the United States came out weaker than expected.

According to the report released by the University of Michigan, preliminary index of consumer sentiment slipped to 82.7 from 84.5. The Labor Department reported that the producer-price index rose 0.5% and data from the Federal Reserve showed that capacity utilization declined to 77.6 from 77.8. However, gold prices continued to bounce around in a tight range throughout the week as the markets had no idea where to go. The recent price action indicates that gold market participants are in a cautious mode ahead of the Federal Open Market Committee policy meeting, at which we may see more clarity into the tapering issue. The U.S. Federal Reserve appears to be much closer to reducing the pace of its purchases to maintain appropriate policy accommodation -likely some time this year- and this is easing speculative demand for the precious metal. The U.S. economy is addicted to quantitative easing and similar to drug addiction the economy demands for higher doses (while its impact becomes less and less), until the ultimate fatal overdose leads to death. I think FOMC members are well aware of this fact and they know that -at the end- the central bank will come to the point where it feels the costs outweigh the benefits of more easing. Technically speaking, the location of the Ichimoku clouds on the weekly and daily time frames shows the bears are still in charge and there are strong resistance levels to the upside.

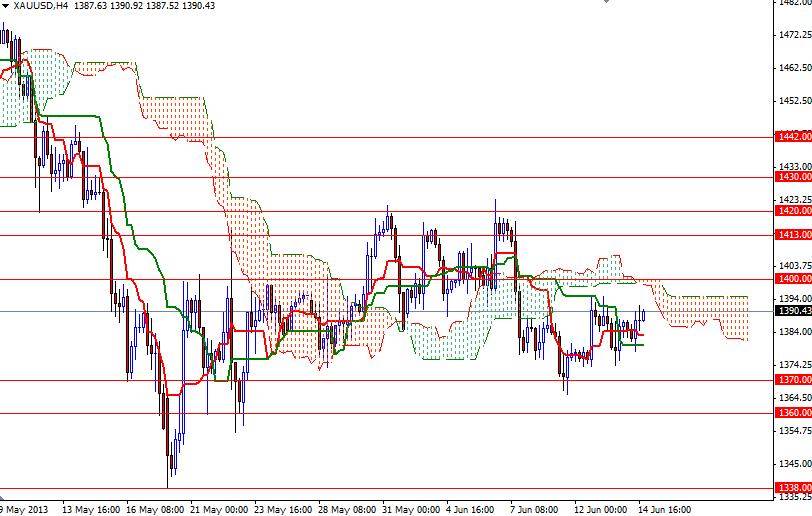

In order to gain some traction, the bulls have to capture the first strategic fort at the 1400 level. Beyond this level, there will be resistance at 1413 and 1420. Only a close above 1420 could give the bulls the extra strength they need to reach the 1442 level. If they bulls encounter heavy resistance and prices start to fall, I will be paying attention to the support levels at 1370 and 1360 and 1354. If the bears manage to break below 1354, at least on a daily basis, I will look for 1338 and 1320. Until the market gets a clear signal from the Fed, we might continue to trade in a relatively short range.