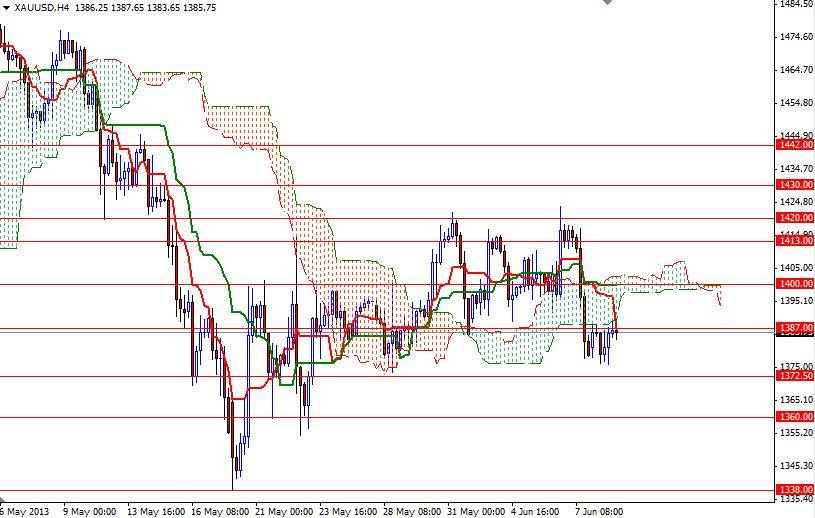

Gold gained some ground against the American dollar during yesterday's session but the market is still feeling the bearish pressure of last week's U.S. employment report. Encouraging figures reinforced expectations that the Federal Reserve will taper or end its asset purchases. The bears have been dominant since prices touched the 1795.75 in October 2012. Although physical demand for gold increased recently, these purchases couldn't reverse the mid-term trend. From a technical perspective, the weekly and daily charts suggest that the bears got more volume and strength behind them. For the last two weeks, the XAU/USD pair has been trying to break through the resistance level of 1420 but each time, weekly settlement happened below the 1400 support level. I see plenty of resistance levels ahead and the bulls will have to fight hard to pass these barriers.

Until the bulls prove their strength and push prices above the 1430 level, which happens to be the 23.6 Fibonacci retracement levels based on the bearish run from 1795.75 to 1321.52, I think that buying gold will continue to be a risky game. However, day traders should keep an eye on the 1387 - 1400 resistance levels. If the pair breaches this zone, resistance can be found at 1408, 1413 and 1420. Right now prices are trading below the Ichimoku cloud on the 4-hour time frame. That means, if the XAU/USD pair breaks below the 1372.50 support level, it is likely that we will test 1360 and 1354.50. The major events this week may be the Bank of Japan policy decision and Germany's constitutional court ruling on the European Central Bank's policies.