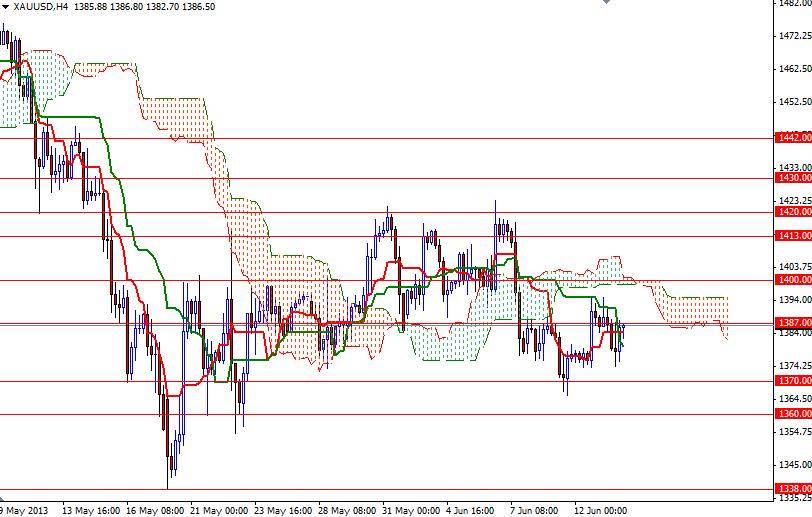

Gold lost some ground against the American dollar but still remained in the last three days trading range. The XAU/USD pair traded as low as 1374.43 after better-than-expected retail sales and unemployment claims figures helped push money back into the dollar and equities. Data released from the Commerce Department showed that retail sales rose %0.6 in May and the Labor Department reported that the number of first-time applicants for jobless benefits dropped by 12000 to 334000. Gold investors have been keeping their focus on the possibility that the Federal Reserve will scale back its massive stimulus measures in coming months and because of that I think that prices will be range bound until the Fed's policy meeting next week. The World Bank's cut to China's economic outlook and slowing demand from India weigh on gold prices. Lately, the 1420 level has been offering heavy resistance and the area around the 1370 has been supportive. From a technical point of view, in the short-term it will be hard to trade gold as the trading range is tightening but at the end will soon reach a point where it will simply have to break one way or the other. The XAU/USD pair is trading below the Ichimoku cloud on both the weekly and daily charts and we have bearish Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-day moving average, green line) crosses.

On the 4-hour time frame, Ichimoku clouds, which represent the area of resistance (or support), intersect with the 1400 level. In other words, I will be waiting for a break above this resistance before opening a short term long position. Unless the bulls break through 1420, prices won't have much room to. Only a sustained break above 1420 could give the bulls enough power to challenge the 1442 hurdle. To the down side, the support levels are located at 1370, 1360 and 1354.50. Breaking below the 1354.50 support may increase the downward pressure drastically.