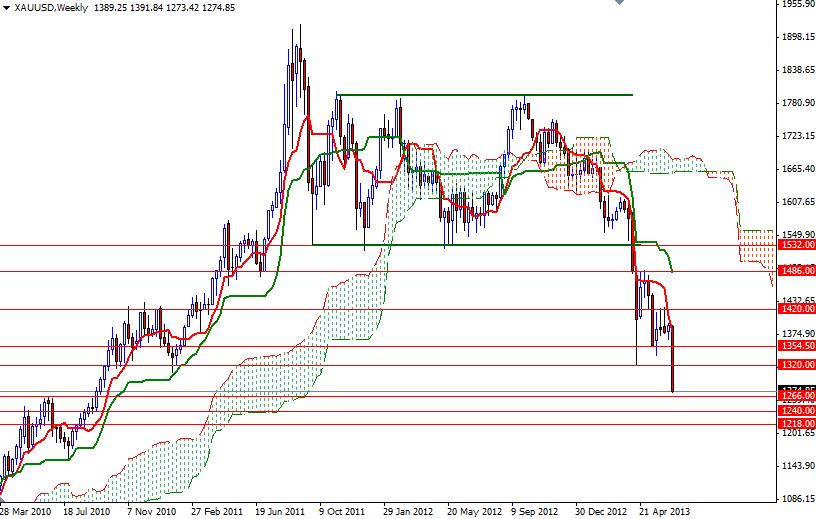

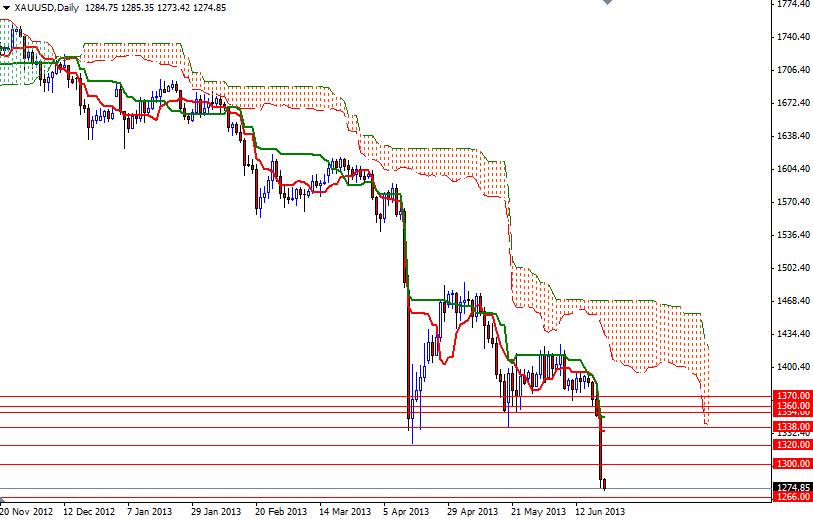

The XAU/USD pair continued to sink and touched the lowest since September 19, 2010. Breaking below the April 16 low of 1321.52 triggered a sell-off which the Fed announcement on Wednesday had prepared the ground. After the central bank's announcement Chairman Ben Bernanke signaled a reduction in the quantitative easing program. Highly disappointing China purchasing managers’ index reading was another catalyst accelerating gold's decline. According to the report released by HSBC, preliminary index of manufacturing activity slipped to 48.3 from 49.2. In the meantime, The CME Group lifted initial margins for Comex gold by %25. Since we broke out of the previous, massive consolidation range (roughly between 1532 and 1795), I have been saying that gold prices will hit the 1266 level and it seems that today we might see it today.

Once we reach to that point, I expect to see some profit taking and probably a pull back. If the charts confirm that this will be the (temporary) bottom, we might head back to the 1300 level first. Beyond this level, the first challenge will be waiting the bulls at 1320. If the bulls manage to break through, the bears will be waiting at 1354.50. If the bears win the battle and prices break below 1266, then the next targets would be 1240 and 1218. Until the conditions in the market place change, any gains for the shiny metal will be limited.