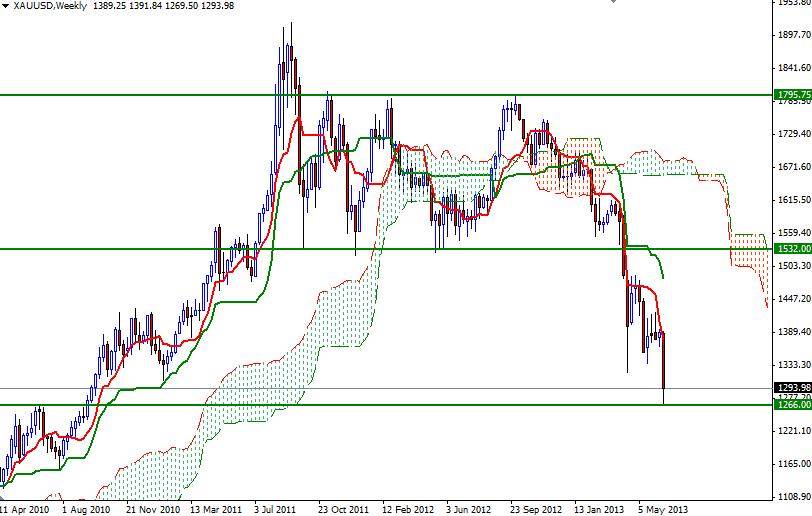

The XAU/USD pair had another bearish weekly candle as investors continued to price in the Fed’s possible reduction in its asset purchase program in coming months. On Wednesday, the Federal Reserve confirmed that it is leaning towards tapering the pace of its massive stimulus measures. However, Fed Chairman Ben Bernanke underlined that the central bank's purchases are tied to what happens in the economy. He also said “If the economy does not improve along the lines that we expect, we will provide additional support”. In the medium term, I think the gold will lose its safe haven appeal because it is very clear that the Fed’s policy stance is tapering and concerns about inflation is fading. In the meantime, slowing growth in China and weakening demand for physical gold might continue to weigh on the XAU/USD pair. From a technical point of view, the overall trend will remain extremely bearish while prices remain below the Ichimoku cloud almost on all time frames. On the other hand, as I mentioned in the previous analysis, the 1266 level may remain intact in the short-term. The XAU/USD pair bounced off of this area on Friday and traded as high as 1302.36 but the weekly settlement was below the 1300 level.

Since the reaction was weaker than I thought, I am thinking that the descending channel that we can see on the daily chart will contain the price action for the rest of the month. On Monday, I will be keeping an eye on the 1300 level. If the bulls manage to shatter this first barrier, it is technically possible see a short-term bounce targeting the upper band of the channel which currently sits at 1368. If that is the case, expect to see resistance at 1320/3, 1338 and 1354. To the downside, there will be support at 1285, 1277.50 and 1266. A daily close below 1266 would suggest that the bears' next target will be 1240.