By: DailyForex.com

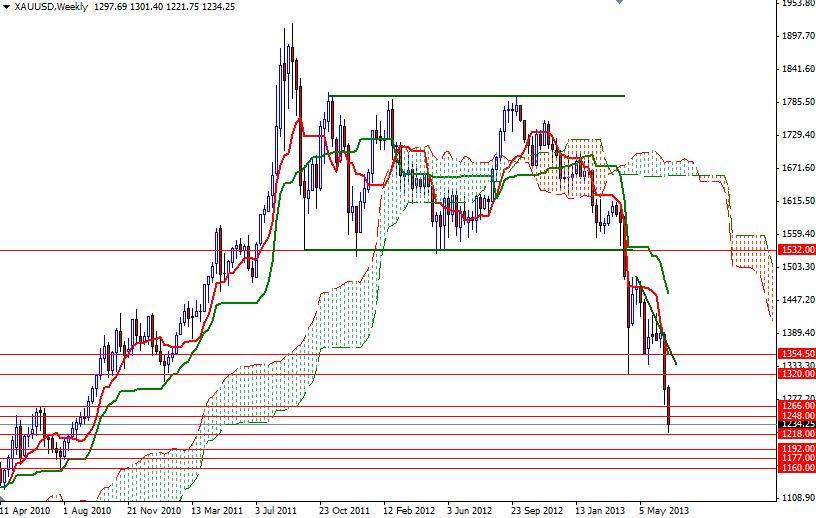

The XAU/USD pair (Gold vs. the American dollar) continued to fall and hit the lowest level since August 25, 2010. The pair traded as low as 1221.75 before recovering slightly to 1234.25 during today's Asian session. The precious metal has been disappointing investors who have been looking for a bottom. Demand for gold reduced significantly since last week, after the Federal Reserve signaled that the era of massive stimulus was coming to an end. The markets participants are still trying to digest the recent events because they have been addicted to quantitative easing and now it became clear that the Fed’s policy stance is tapering. Although the GDP numbers out of the world's largest economy were disappointing, the gold market's reaction was limited. According to the report released by the Bureau of Economic Analysis, gross domestic product (the output of goods and services produced by labor and property located in the U.S.) grew at an annual rate of 1.8% in the first quarter of 2013. Since market sentiment is ultimately driven by the possibility of a reduction in Fed's quantitative easing program, I think today's unemployment claims and pending home sales figures will draw more attention than usual. If new economic data ease concerns the Federal Reserve might soon begin to withdraw stimulus, we might see a retracement. Today the key levels to watch will be the 1218 and 1248 levels.

If the bears drag prices below the 1218 level, there are bunch of supports such as 1192, 1177 and 1160. Even if the long term trend is favoring the bears, these levels may attract enough buyers for a short term bounce. To the upside, first challenge will be waiting the bulls at 1248. If they can manage to push the pair above this resistance level, look for 1266 and 1276.