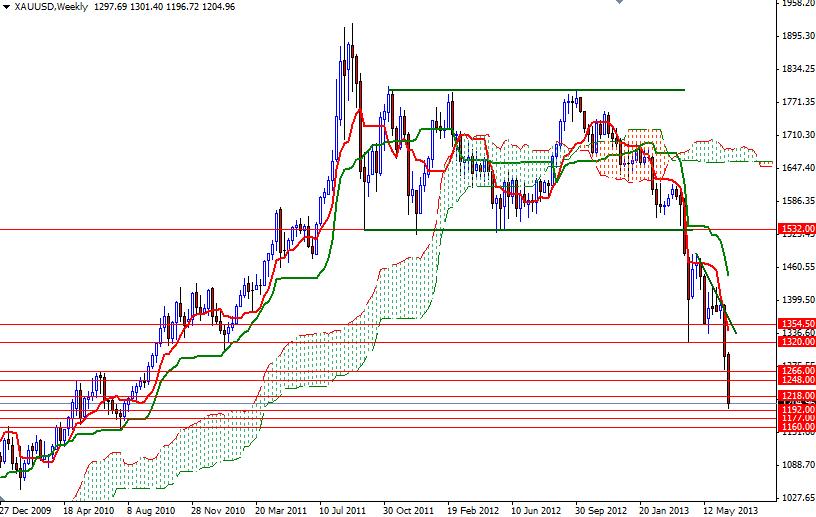

The XAU/USD pair printed another bearish candle yesterday on the back of the encouraging U.S. economic figures. The report released by the Commerce Department showed that consumer spending climbed 0.3% after a 0.3% decline the prior month and the Labor Department reported that initial jobless claims dropped by 9K to 346K. Another data showed that the index of pending home sales jumped 6.7%. The American dollar is heavily influenced by optimistic data and market players are not interested in buying gold under these circumstances. The Federal Reserve seems to be much closer to end (or reduce) quantitative easing, some time this year and of course this is easing speculative demand for gold. Yesterday, Federal Reserve Bank of Atlanta President Dennis Lockhart repeated that interest rates will remain at historic lows at least until the unemployment rate falls below 6.5%. As I told in my previous analysis, until the market conditions (both fundamentally and technically) change, hunting with the bears might be the best idea. Yesterday's settlement was below the 1218 level and right now the pair is hovering just above the 1192 support level. If this support gives way, 1177 and 1160 levels will be the next possible targets. Looking at the weekly charts from a purely technical point of view, the odds favor a bit of a bounce after we test these support levels. Today is also the last trading day of the second quarter so it is very likely that we will see some profit taking. To the upside, expect to see resistance at 1213, 1225 and 1248.

Gold Price Analysis - June 28, 2013

By Alp Kocak

By Alp Kocak

Alp Kocak has been trading Forex since 2003. He writes technical analysis based on Japanese candlesticks and Ichimoku Kinko Hyo.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox. Please enter a valid email address

By Alp Kocak

Alp Kocak has been trading Forex since 2003. He writes technical analysis based on Japanese candlesticks and Ichimoku Kinko Hyo. - Labels

- Gold