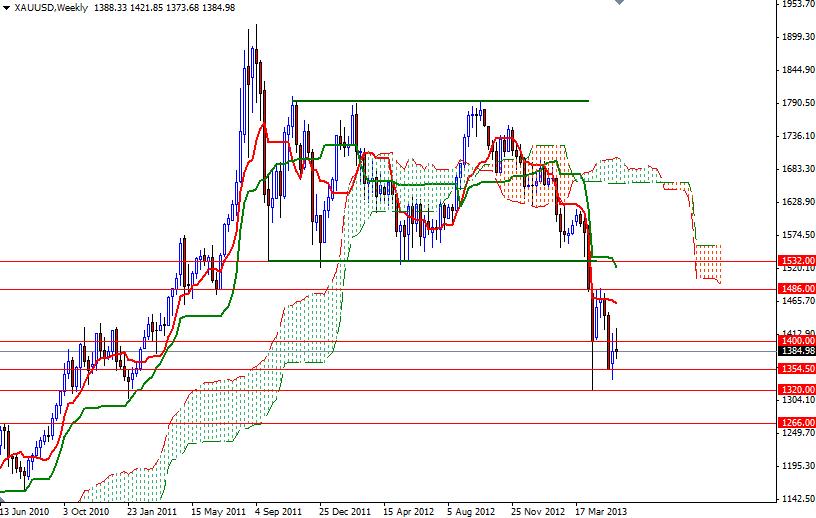

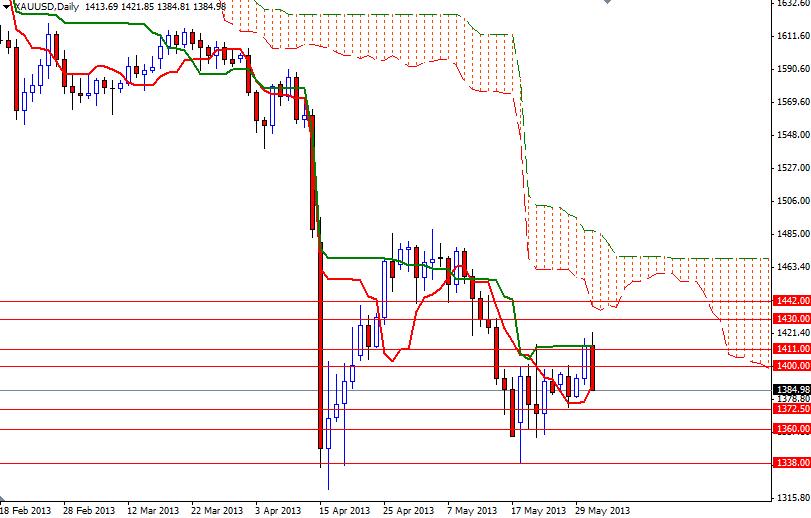

The XAU/USD pair ended the week lower after the Friday's bearish price action. Gold prices fell sharply on the last trading day of the week and month after the economic data released from the Unite States provided further evidence that the world's biggest economy is continuing to recover. The latest numbers revealed that the University of Michigan consumer sentiment index rose to 84.5 from 76.4 a month earlier and Chicago PMI climbed to 58.7 in May from 49 in April. According to the Commitments of Traders report, released by the Commodity Futures Trading Commission, speculative traders continued to increase their short positions. Friday's data stoked speculations that the Federal Reserve could slow its asset buying in coming months and the bears used this opportunity to increase selling pressure and drag prices below the 1400 level. This level has been hindering the bulls' advance for some time and it might still continue to do so. Weekly candle suggests that higher prices are being rejected by traders. On the weekly and daily charts, the XAU/USD pair remains below the Ichimoku clouds and we have bearish Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-day moving average, green line) crosses, indicating that the long term outlook is still bearish.

This week, I think that 1400 and 1372.50 will be the key levels to watch. Despite a combination of gold supportive factors such as purchases by central banks and increasing demand for physical gold, I will be paying more attention to the charts. In the meantime, I will also keep an eye on the USD/JPY pair and U.S shares. If selling accelerates, investors might abandon stocks and flock to gold. If the pair successfully drops below 1372.50, it will resume the bearish sentiment and test the 1360 support level. A weekly close below the 1354.50 means 1338 and 1320 will be the next target. If the bulls manage to push prices back up and close above the 1400 level, we might see a bullish continuation targeting 1442 at least. However, if that is the case, expect to see resistance at 1411/3 and 1430.