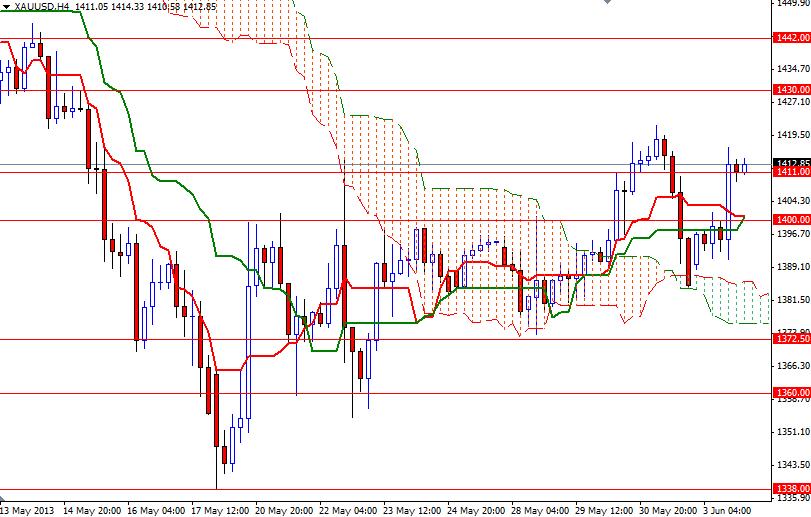

The XAU/USD pair (Gold vs. the American dollar) scored a gain of 1.89% on Monday after the disappointing manufacturing data out of the world largest economy eased concerns that the U.S. Federal Reserve might soon start unwinding its massive stimulus. Data released by the Institute for Supply Management showed that its factory index decreased to 49 in May from the prior month’s 50.7. ISM's figures indicate that the U.S. economy is still far from full health. I believe the Fed will consider cutting back on the $85 billion monthly bond purchases sometime this year but the data we are receiving are still very mixed. Considering current labor market conditions, I think the Federal Open Market Committee members might prefer to wait until they believe that the economy is gaining strong momentum. In the meantime, they will be sticking with the current approach to support the recovery and to improve employment conditions. In the short term, this would be supportive for gold but gains will be limited due to gloomy outlook of the global economy. Charts also paint a similar picture. Currently the XAU/USD pair is trading above the Ichimoku cloud on the 4-hour time frame and the Tenkan-sen line (nine-period moving average, red line) is above the Kijun-sen line (twenty six-day moving average, green line).

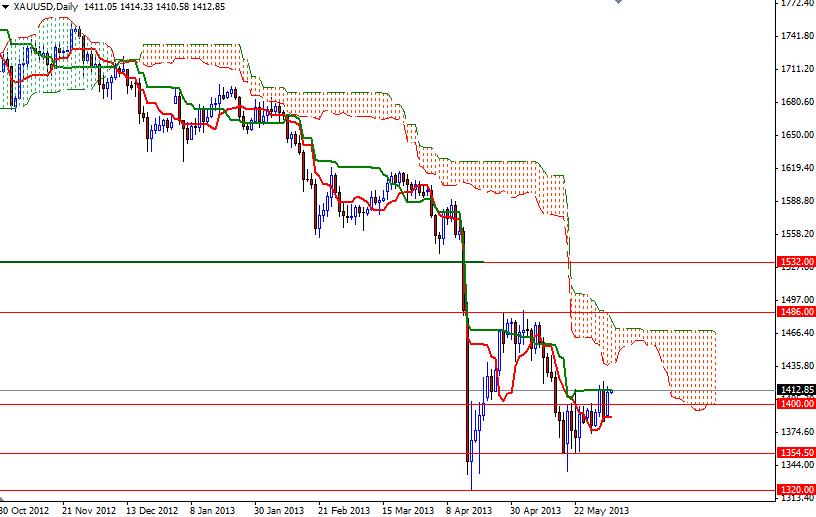

From a purely technical point of view, the odds favor a bit of a bounce, as long as prices hold above the 1400 level but there are strong resistance levels ahead of us. If the pair breaks through 1420, more resistance will be waiting at 1430 and 1442. If the bears win the fight and push prices below the 1400 support level, look for 1386, 1377 and 1372.50. A daily close below 1372.50 would make be think that we will visit 1360 next.