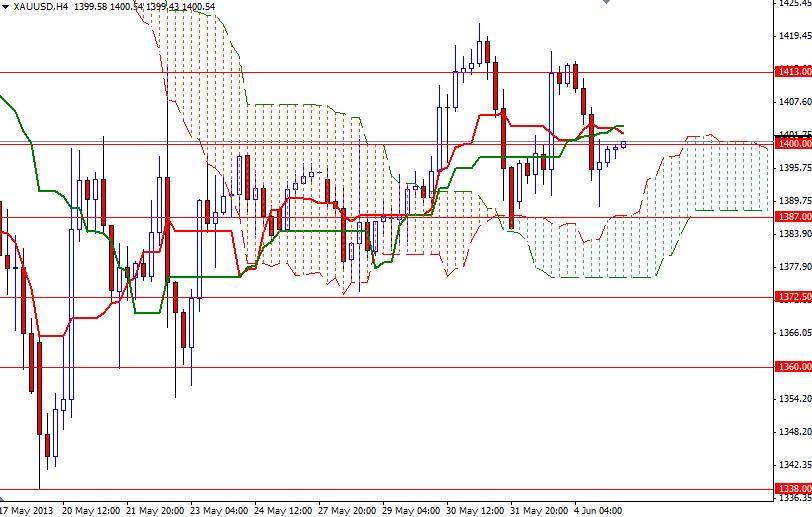

The XAU/USD pair closed yesterday's session lower than opening but remained within the last four days’ trading range. Gold prices lost some ground against the greenback after Kansas City Federal Reserve Bank President Esther George, who is a voting member of the Federal Open Market Committee, said “I support slowing the pace of asset purchases as an appropriate next step for monetary policy”. Over recent weeks a number of Fed officials have suggested they could start paring bond purchases as soon as the Fed's next few meetings if the outlook for labor market conditions improves as anticipated. As you can see on the charts, the gold market has been going back and forth in a tight range recently. On the 4-hour time frame, the XAU/USD pair is still supported by the Ichimoku clouds right below. Because of this, I think this market as more of an upward bias in the short term.

Although I do not see a magic catalyst at this point to make this market skyrocket, a daily close above the 1413 level (which is the Kijun Sen line on the daily time frame) would make me think that the bulls will likely continue their advance towards the next strong resistance levels. If gold prices hold above the Ichimoku cloud on the 4-hour chart, I will be looking for 1413, 1430 and 1442. As I mentioned in my previous analysis, I think we will encounter heavy resistance between 1442 and 1486 levels which defined the borders of previous consolidation. If the bears take over and prices break below 1387, support may be found at 1377, 1372.50 and 1360. Today sees release of important economic reports from the United States such as ISM Non-Manufacturing PMI, Factory Orders and ADP Non-Farm Employment Change, therefore expect some volatility. In the meantime, I will be monitoring the USD/JPY pair as well.