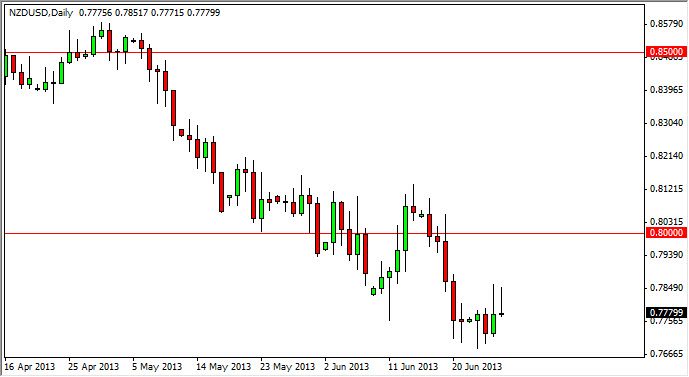

The NZD/USD pair rose during the session on Thursday, but as you can see the sellers got the upper hand by the end of the day forming a shooting star. This is the second shooting star in a row, and that follows three hammers. This means to me that we are going to grind sideways in the New Zealand dollar pair for a while, but this makes sense as the commodity markets are taken an absolute shellacking lately.

The one thing that's a bit different about the New Zealand dollar is that it tends to follow the soft commodities, something that most of you probably don't pay attention to. New Zealand is a massive exporter of agricultural products, and those agricultural products normally end up in Asia. So watching the Asian markets and the economies in places like China, Japan, and most specifically Southeast Asia, you can get a feel for what the New Zealand economy may end up being like. It's hard for most Western traders to understand this, but there are parts of the world that make decisions about eating based upon the local economy. Unlike in the United States or Europe, people do not necessarily buy beef very often. It really comes down to the economic situation. However, the very poor Asian country, how the economy is doing can have a massive effect on how much agricultural products are bought.

The Kiwi is also an excellent barometer of commodity and risk in general.

The Kiwi dollar also has the liberty to follow the general attitude of the commodity markets overall, and as a result if you know the general direction of most commodities, you know the general direction of the New Zealand dollar itself. Looking at this chart, I can make a significant argument for the 0.77 level being very supportive, and a break of the Monday hammer of course signifies further losses to me. At that point time, I would not hesitate to sell this pair going down to the 0.75 handle. However, there's always the chance that we get a bit of a bounce, but I don't see this market being overly productive until we get above the 0.82 handle. Until then, I believe that resistive candles are simple opportunities to sell.