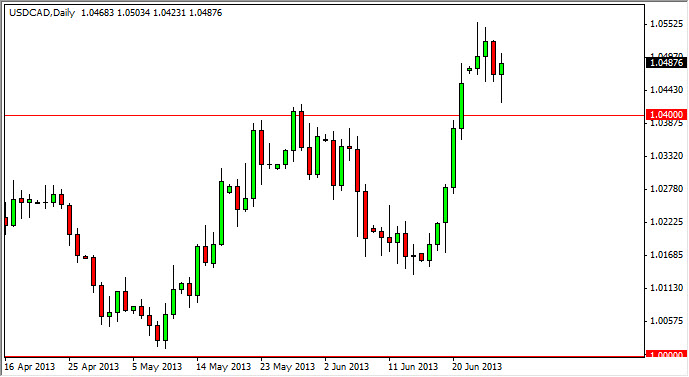

The USD/CAD currency pair fell during the balance of the Thursday session, but as you can see the 1.04 level did offer enough support to keep the sellers at bay. The resulting candle suggests that there is going to be a significant amount of support in this area, something that you have seen me write about in the last couple of sessions. The hammer of course signifies that the support has already started, and as a result I think we will eventually break above the recent high at the 1.0550 level.

This market has a long history of going sideways for a significant amount of time and then suddenly skyrocketing in one direction or the other. I think we are about see this, and as a result a move above the 1.0550 level would indeed bring in a rush of new buying. Do not forget that the oil markets are a great influence on this pair, and as a result we need to see this market coincide with a downdraft in the Light Sweet Crude pair as it has a massive influence on this market simply because of the Canadian dollar as the Canadians export 85% of their crude oil to the United States.

I have no plans to sell this market at all.

Looking forward, I see aptly no reason to buy the Canadian dollar over the US dollar as the greenback is by far the most favored currency around the world. Simply put, money is flowing into the United States because it is one of the rare places in the world where we are starting to see growth again. Eventually, this will benefit the Canadian economy, but at the moment we see problems with the Canadian workforce, as well as GDP.

Watch the oil markets going forward, and I suggest that if we can break below the 92 points or zero dollars level in the Light Sweet Crude markets, or the WTI, we could see this market really take off to the upside. I do believe eventually we will see the 1.10 level, but it could take a while to get there.