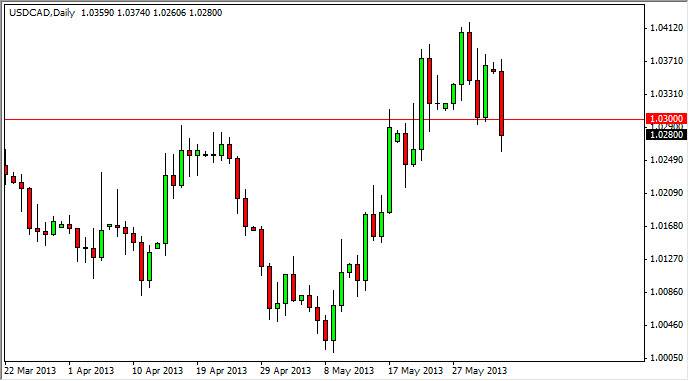

The USD/CAD currency pair had a very negative session on Monday, breaking below the 1.03 handle. However, there is now support below there to make me a little bit leery of selling at this point, and I would stay away from doing so until we get below the 1.02 handle. It is down there that I think this market could really start to fall apart.

The US dollar got whacked against most other currencies around the world as the PMI numbers came out of America rather weak, and in contraction. Nonetheless, it is just barely below the 50 level, so it's really not that big of a deal, and we have to wait and see whether or not the market has overreacted. This would have been a reaction to the possibility that the Federal Reserve is not going to pull away from quantitative easing as soon as a lot of the market place participants had anticipated. This of course would have a weakening of fact on the US dollar over the longer term, but ironically the Canadian economy is almost fully dependent upon the Americans. So in a roundabout kind of way, it would not surprise me to see money come flying into this marketplace as 85% of the exports out of Canada will be affected.

Erratic behavior

This pair has a long history of grinding sideways and then suddenly exploding in one direction or the other. In fact, it is probably one of the most volatile pairs once it starts actually moving. That's the trick though, as it does like this is sideways for long periods of time. This of course is because of the aforementioned relationship between the two economies, but I recognize a break of the 1.04 level as a severe signals that we are about to break much, much higher. Because of this, I think that if we find a supportive candle somewhere in the near-term, we could have a serious attack on the 1.04 handle. Above there, I'm actually looking for this market to move the size 1.10 over the longer term. Below the 1.02 handle however, in this market will certainly test parity yet again.