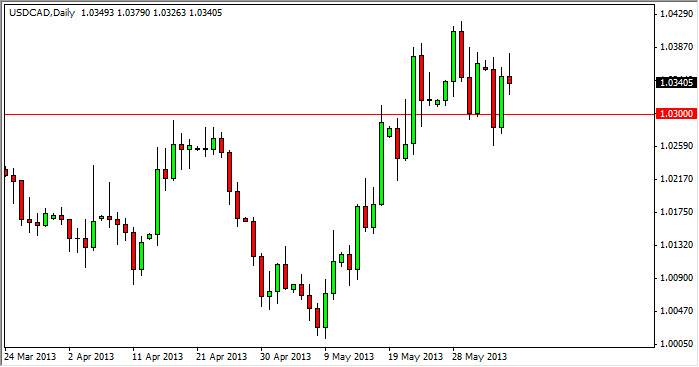

The USD/CAD pair tried to rally during the session on Wednesday, but as you can see once he got above the 1.0350 level, it struggled. The resulting pullback formed a shooting star, and I believe that this represents a tightening of the trading range, nothing more, and nothing less. After all, you have to keep in mind that the nonfarm payroll number is coming out on Friday, and this pair is extremely sensitive to that particular economic indicator.

This is essentially because the Canadian send 85% of their exports into the United States. With that in mind, the Americans need to have job so they can violence Canadian goods, naturally. That is why the nonfarm payroll number in the United States is probably the most important Canadian economic indicator.

With that being said, I cannot help but notice the fact that this market looks like it's trying to form a bullish flag at the moment. I don't think that anything will be triggered of the next 24 hours however, since that indicator will be so important. That being said, I believe that a break above the 1.04 level would be a massive buy signal as we should attack 1.05 right away, and perhaps go as high as 1.10 before the week move is done.

Choppy conditions ahead

I for the life of me cannot think of anything that could come out over the next 24 hours that will move this market beyond perhaps pulling back towards the 1.03 level. Because of this, I will simply stay out of the market, but the short-term trader might find value in shorting this market if we break the lows from the Wednesday session. After all, that is a classic sell signal as it is the breaking of the support on a shooting star. As for buying, I suppose a break above 1.04 would be enough to get involved, but I cannot help but think that would take some type of major news headline to make that happen before the nonfarm payroll numbers coming out on Friday.